Question: 1. Why did Altria report a loss in the third quarter. Explain your answer well in about 50 words 2. Note that certain expenses are

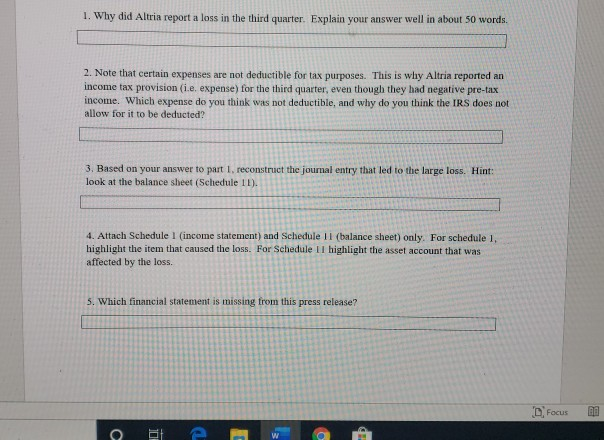

1. Why did Altria report a loss in the third quarter. Explain your answer well in about 50 words 2. Note that certain expenses are not deductible for tax purposes. This is why Altria reported an income tax provision (ie, expense) for the third quarter, even though they had negative pre-tax income. Which expense do you think was not deductible, and why do you think the IRS does not allow for it to be deducted? 3. Based on your answer to part 1 reconstruct the journal entry that led to the large loss. Hint: look at the balance sheet (Schedule 11). 4. Attach Schedule 1 (income statement) and Schedule 1l (balance sheet) only. For schedule I. highlight the item that caused the loss. For Schedule 1 highlight the asset account that was affected by the loss. 5. Which financial statement is missing from this press release? Focus on te w 1. Why did Altria report a loss in the third quarter. Explain your answer well in about 50 words 2. Note that certain expenses are not deductible for tax purposes. This is why Altria reported an income tax provision (ie, expense) for the third quarter, even though they had negative pre-tax income. Which expense do you think was not deductible, and why do you think the IRS does not allow for it to be deducted? 3. Based on your answer to part 1 reconstruct the journal entry that led to the large loss. Hint: look at the balance sheet (Schedule 11). 4. Attach Schedule 1 (income statement) and Schedule 1l (balance sheet) only. For schedule I. highlight the item that caused the loss. For Schedule 1 highlight the asset account that was affected by the loss. 5. Which financial statement is missing from this press release? Focus on te w

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock