Question: 1. Why did Argenti need to increase it's notes payable borrowing to more than $1 billion in 20x5? 2. What recommendation would you make regarding

1. Why did Argenti need to increase it's notes payable borrowing to more than $1 billion in 20x5?

1. Why did Argenti need to increase it's notes payable borrowing to more than $1 billion in 20x5?

2. What recommendation would you make regarding the companys request for a $1.5 billion refinancing package?

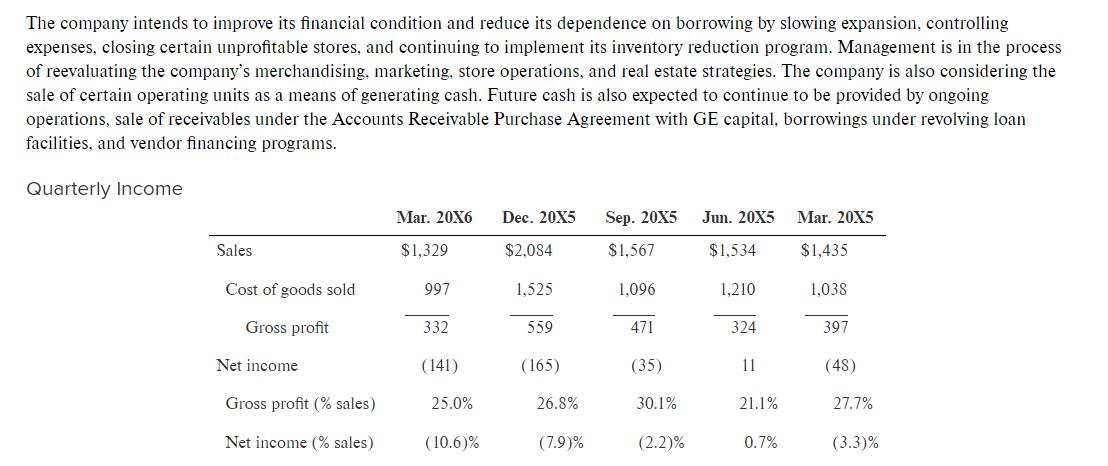

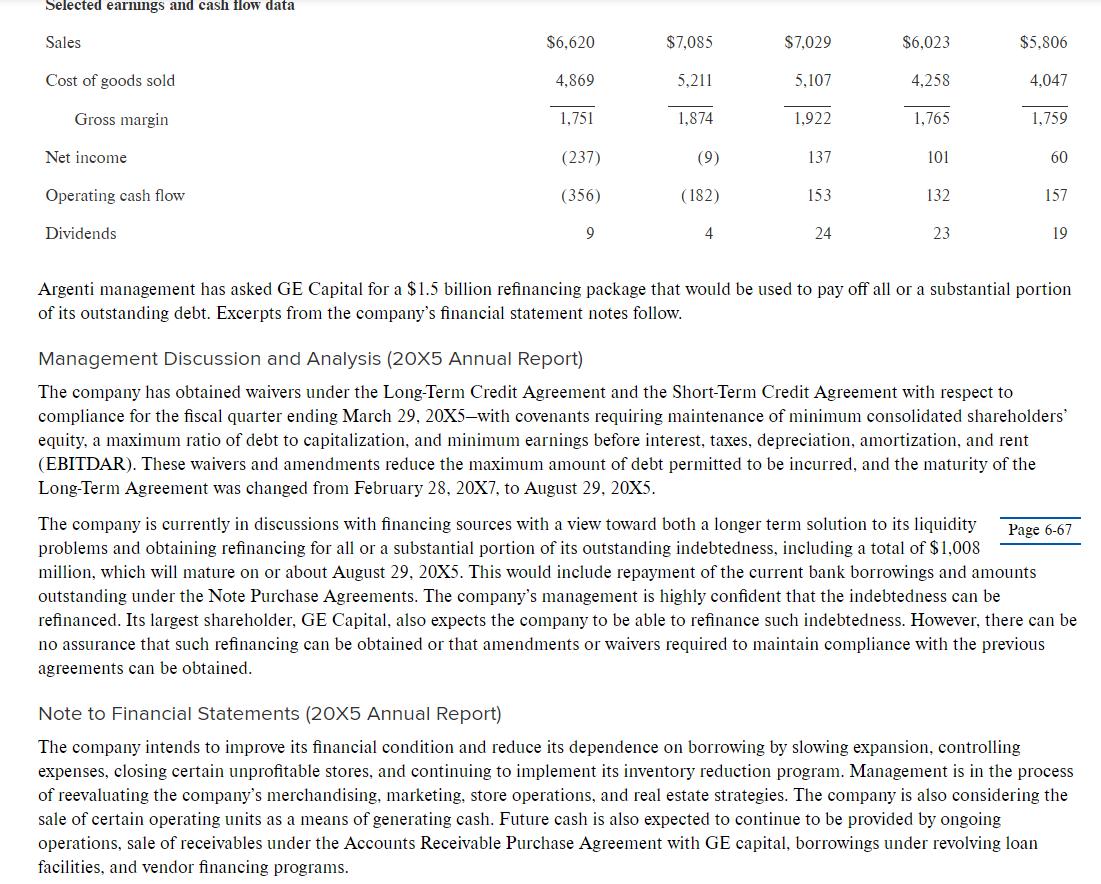

The company intends to improve its financial condition and reduce its dependence on borrowing by slowing expansion, controlling expenses, closing certain unprofitable stores, and continuing to implement its inventory reduction program. Management is in the process of reevaluating the company's merchandising, marketing, store operations, and real estate strategies. The company is also considering the sale of certain operating units as a means of generating cash. Future cash is also expected to continue to be provided by ongoing operations, sale of receivables under the Accounts Receivable Purchase Agreement with GE capital, borrowings under revolving loan facilities, and vendor financing programs. Quarterly Income Sales Cost of goods sold Gross profit Net income Gross profit (% sales) Net income (% sales) Mar. 20X6 Dec. 20X5 $1,329 $2,084 1,525 559 (165) 997 332 (141) 25.0% (10.6)% 26.8% (7.9)% Sep. 20X5 $1,567 1,096 471 (35) 30.1% (2.2)% Jun. 20X5 $1,534 1,210 324 11 21.1% 0.7% Mar. 20X5 $1,435 1,038 397 (48) 27.7% (3.3)%

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts