Question: 1 Why do you borrow? Construct a in ONE ONLY spreadsheet that would indicate the profit rate and profit in dollars if you purchase given

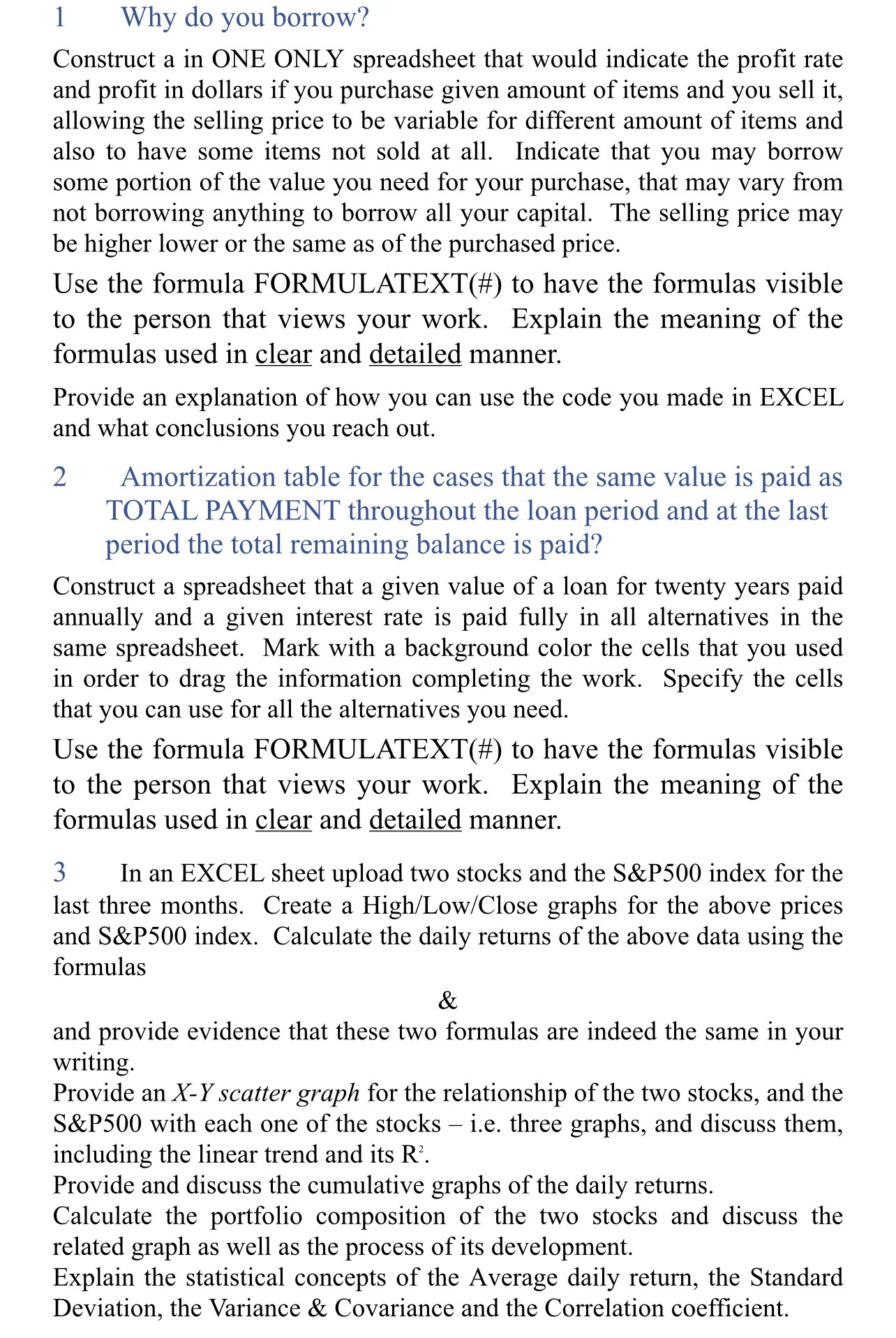

Why do you borrow?

Construct a in ONE ONLY spreadsheet that would indicate the profit rate

and profit in dollars if you purchase given amount of items and you sell it

allowing the selling price to be variable for different amount of items and

also to have some items not sold at all. Indicate that you may borrow

some portion of the value you need for your purchase, that may vary from

not borrowing anything to borrow all your capital. The selling price may

be higher lower or the same as of the purchased price.

Use the formula FORMULATEXT# to have the formulas visible

to the person that views your work. Explain the meaning of the

formulas used in clear and detailed manner.

Provide an explanation of how you can use the code you made in EXCEL

and what conclusions you reach out.

Amortization table for the cases that the same value is paid as

TOTAL PAYMENT throughout the loan period and at the last

period the total remaining balance is paid?

Construct a spreadsheet that a given value of a loan for twenty years paid

annually and a given interest rate is paid fully in all alternatives in the

same spreadsheet. Mark with a background color the cells that you used

in order to drag the information completing the work. Specify the cells

that you can use for all the alternatives you need.

Use the formula FORMULATEXT# to have the formulas visible

to the person that views your work. Explain the meaning of the

formulas used in clear and detailed manner.

In an EXCEL sheet upload two stocks and the S&P index for the

last three months. Create a HighLowClose graphs for the above prices

and S&P index. Calculate the daily returns of the above data using the

formulas

&

and provide evidence that these two formulas are indeed the same in your

writing.

Provide an scatter graph for the relationship of the two stocks, and the

S&P with each one of the stocks ie three graphs, and discuss them,

including the linear trend and its

Provide and discuss the cumulative graphs of the daily returns.

Calculate the portfolio composition of the two stocks and discuss the

related graph as well as the process of its development.

Explain the statistical concepts of the Average daily return, the Standard

Deviation, the Variance & Covariance and the Correlation coefficient.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock