Question: 1. Why does investment analysis focus on cash flow rather than revenue and expense? 2. Suppose that two projects each cost $10,000. The first project

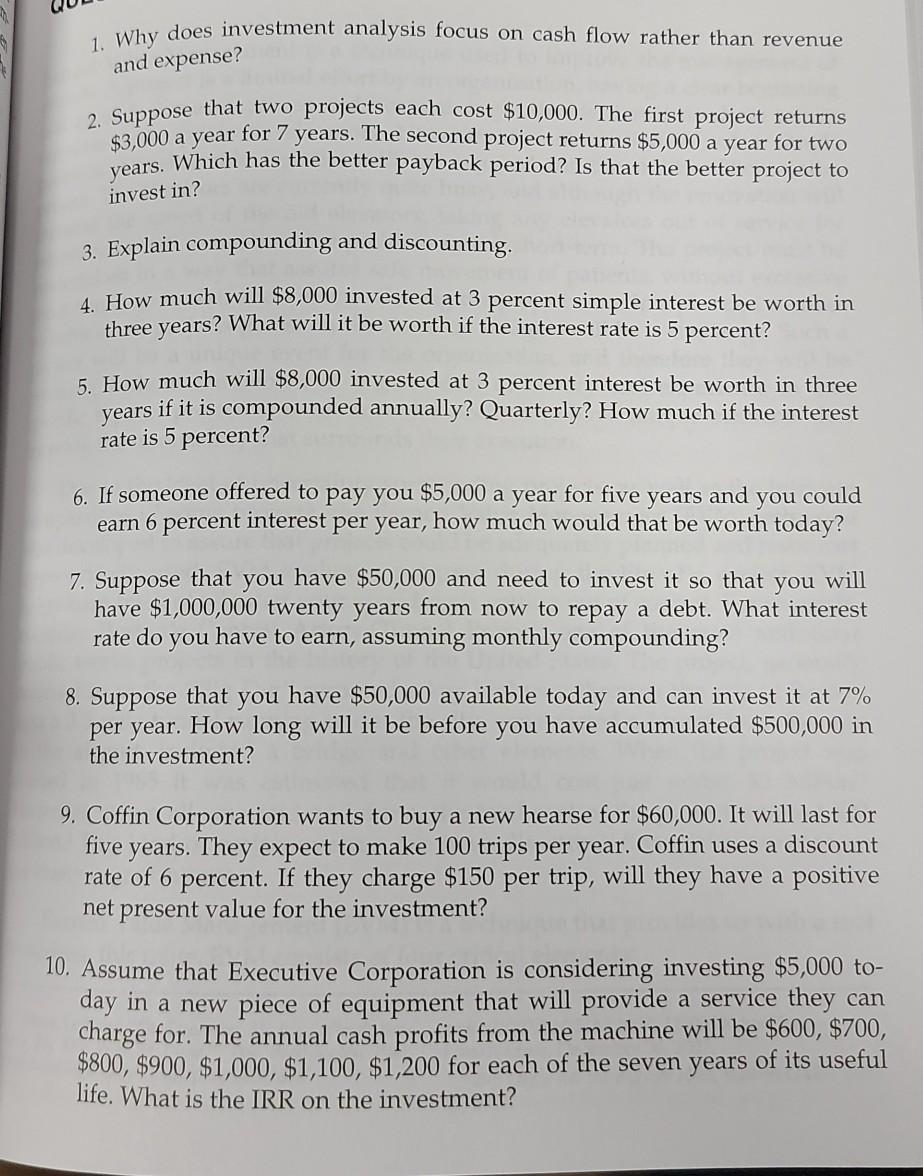

1. Why does investment analysis focus on cash flow rather than revenue and expense? 2. Suppose that two projects each cost $10,000. The first project returns $3,000 a year for 7 years. The second project returns $5,000 a year for two years. Which has the better payback period? Is that the better project to invest in? 3. Explain compounding and discounting. 4. How much will $8,000 invested at 3 percent simple interest be worth in three years? What will it be worth if the interest rate is 5 percent? 5. How much will $8,000 invested at 3 percent interest be worth in three years if it is compounded annually? Quarterly? How much if the interest rate is 5 percent? 6. If someone offered to pay you $5,000 a year for five years and you could earn 6 percent interest per year, how much would that be worth today? you will 7. Suppose that you have $50,000 and need to invest it so that have $1,000,000 twenty years from now to repay a debt. What interest rate do you have to earn, assuming monthly compounding? 8. Suppose that you have $50,000 available today and can invest it at 7% per year. How long will it be before you have accumulated $500,000 in the investment? 9. Coffin Corporation wants to buy a new hearse for $60,000. It will last for five years. They expect to make 100 trips per year. Coffin uses a discount rate of 6 percent. If they charge $150 per trip, will they have a positive net present value for the investment? 10. Assume that Executive Corporation is considering investing $5,000 to- day in a new piece of equipment that will provide a service they can charge for. The annual cash profits from the machine will be $600, $700, $800, $900, $1,000, $1,100, $1,200 for each of the seven years of its useful life. What is the IRR on the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts