Question: 1. why does kne problem start with 0 as the stock price and the other starts with 32 stock price? 2. how do i know

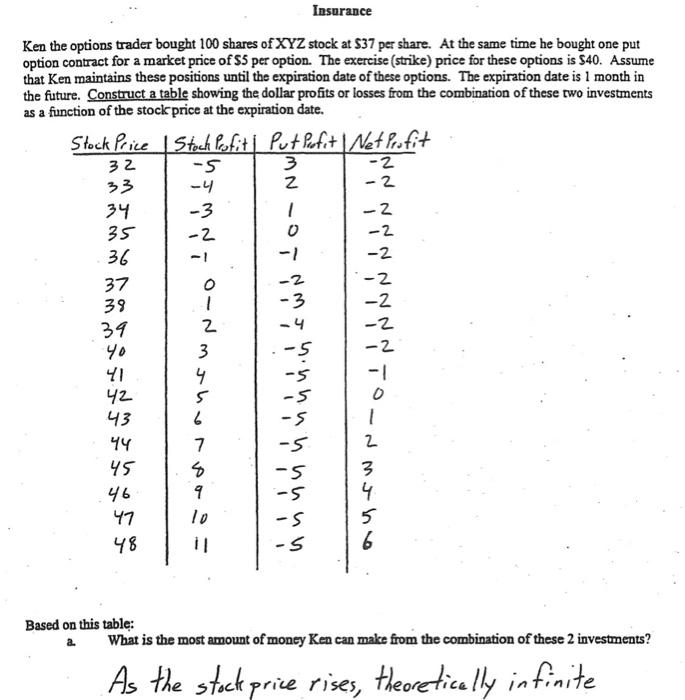

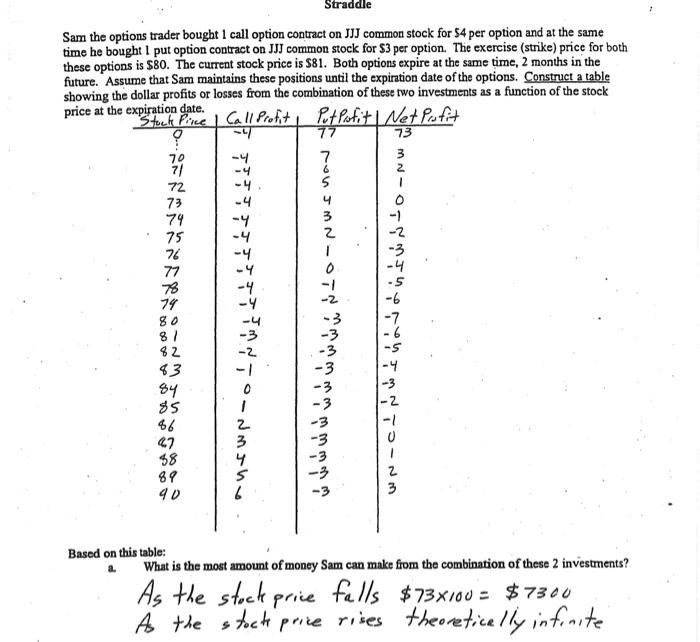

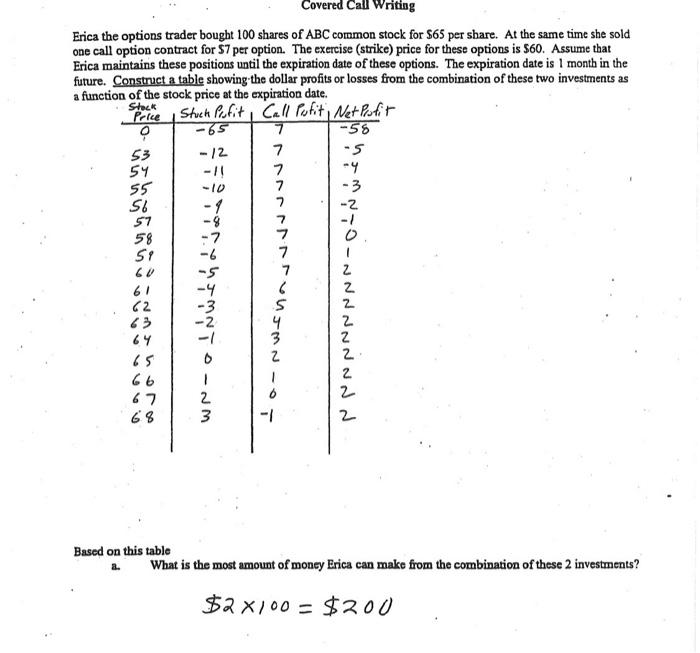

I w s -2 NN Insurance Ken the options trader bought 100 shares of XYZ stock at $37 per share. At the same time he bought one put option contract for a market price of $5 per option. The exercise (strike) price for these options is 540. Assume that Ken maintains these positions until the expiration date of these options. The expiration date is 1 month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock Price Stock Profiti Put Profit | Net Profit 32 -2 33 -2 34 -3 -2 35 -2 36 -2 37 O -2 39 -2 34 2 -2 40 3 5 -2 41 4 -1 42 5 43 6 1 44 7 2 45 S 3 46 9 4 47 10 5 48 il 6 n n nin's w to - nw -5 Based on this table: a What is the most amount of money Ken can make from the combination of these 2 investments? As the stock price rises theoretically infinite , 3 Straddle Sam the options trader bought I call option contract on JJJ common stock for 54 per option and at the same time he bought I put option contract on JJJ common stock for $3 per option. The exercise (strike) price for both these options is $80. The current stock price is $81. Both options expire at the same time, 2 months in the future. Assume that Sam maintains these positions until the expiration date of the options. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. *Stock Price Call Profit, pet putiti Net Profit ? 77 70 7 7/ 72 -4 5 73 4 3 75 -4 2 -2 76 -4 1 -3 77 -4 0 78 -4 79 -Y -2 80 -4 -7 81 -3 82 -2. -3 83 74 wN-cl w snavsusuntoon 84 1 w w w w w w w w w w w $5 86 47 98 89 40 2 3 Based on this table: What is the most amount of money Sam can make from the combination of these 2 investments? As the stock price falls $73x100 = $ 7300 As the stock price rises theoretically infinite 7 Covered Call Writing Erica the options trader bought 100 shares of ABC common stock for $65 per share. At the same time she sold one call option contract for 57 per option. The exercise (strike) price for these options is $60. Assume that Erica maintains these positions until the expiration date of these options. The expiration date is 1 month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock Price Stuck Pofit, Call rolit Net Profit 0 -65 7 -58 53 -12 7 S -1! 7 55 7 -3 S -2 7 58 -7 S 7 6V 7 6" ( -3 S 43 69 3 S . 46 67 2 68 3 | 2 144444446 *** - NNNNN N 3 4 (2 6 - M Based on this table . What is the most amount of money Erica can make from the combination of these 2 investments? $3X) 00 - $200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts