Question: 1. why the most you can make 200? 2. the break even point is is at the stock price 58 which results in net profit

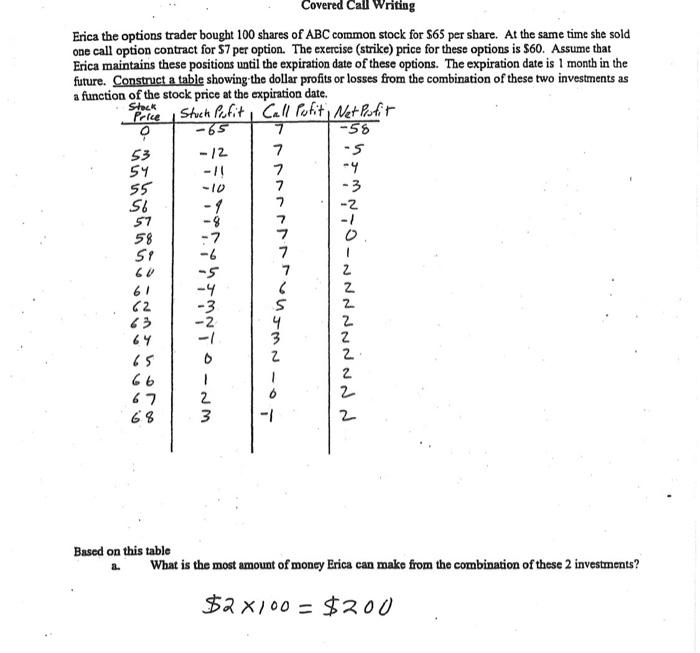

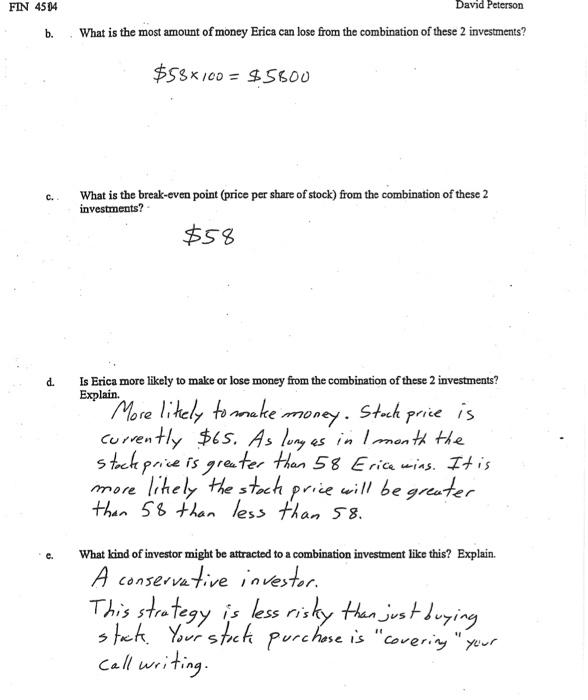

Covered Call Writing Erica the options trader bought 100 shares of ABC common stock for $65 per share. At the same time she sold one call option contract for 57 per option. The exercise (strike) price for these options is $60. Assume that Erica maintains these positions until the expiration date of these options. The expiration date is 1 month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock Price Shuck Pofit, Call rolit Net Profit -65 7 -55 53 -12 -5 54 -4 55 -3 S6 -2 58 5! 6V 61 62 63 64 65 66 67 68 Inwch 77777777ST32 161 6 4 Z 2 2 2 Z 2 2 2 2 D-NM 2 3 -1 Based on this table What is the most amount of money Erica can make from the combination of these 2 investments? $2 x100 = $200 FIN 4514 David Peterson b. What is the most amount of money Erica can lose from the combination of these 2 investments? $53*100 = $ 5600 C. What is the break-even point (price per share of stock) from the combination of these 2 investments? $58 d. Is Erica more likely to make or lose money from the combination of these 2 investments? Explain. More likely to make money. Stock price is currently $65. As long as in 1 month the stocle price is greater than 58 Erice wias. It is more likely the stock price will be greater than 58 than less than 58. What kind of investor might be attracted to a combination investment like this? Explain. A conservative invester. This strategy is less risky than just buying steck Your stocke purchase is "covering your call writing. Covered Call Writing Erica the options trader bought 100 shares of ABC common stock for $65 per share. At the same time she sold one call option contract for 57 per option. The exercise (strike) price for these options is $60. Assume that Erica maintains these positions until the expiration date of these options. The expiration date is 1 month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock Price Shuck Pofit, Call rolit Net Profit -65 7 -55 53 -12 -5 54 -4 55 -3 S6 -2 58 5! 6V 61 62 63 64 65 66 67 68 Inwch 77777777ST32 161 6 4 Z 2 2 2 Z 2 2 2 2 D-NM 2 3 -1 Based on this table What is the most amount of money Erica can make from the combination of these 2 investments? $2 x100 = $200 FIN 4514 David Peterson b. What is the most amount of money Erica can lose from the combination of these 2 investments? $53*100 = $ 5600 C. What is the break-even point (price per share of stock) from the combination of these 2 investments? $58 d. Is Erica more likely to make or lose money from the combination of these 2 investments? Explain. More likely to make money. Stock price is currently $65. As long as in 1 month the stocle price is greater than 58 Erice wias. It is more likely the stock price will be greater than 58 than less than 58. What kind of investor might be attracted to a combination investment like this? Explain. A conservative invester. This strategy is less risky than just buying steck Your stocke purchase is "covering your call writing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts