Question: 1. Wildhorse Inc Analysis View Policies Current Attempt in Progress Wildhorse Inc. manufactures basketballs for the Women's National Basketball Association (WNBA). For the first 6

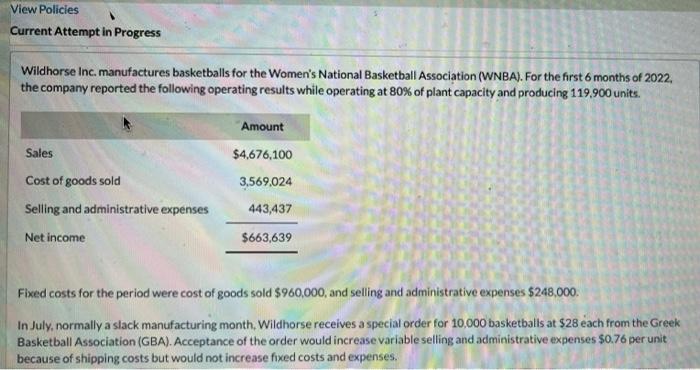

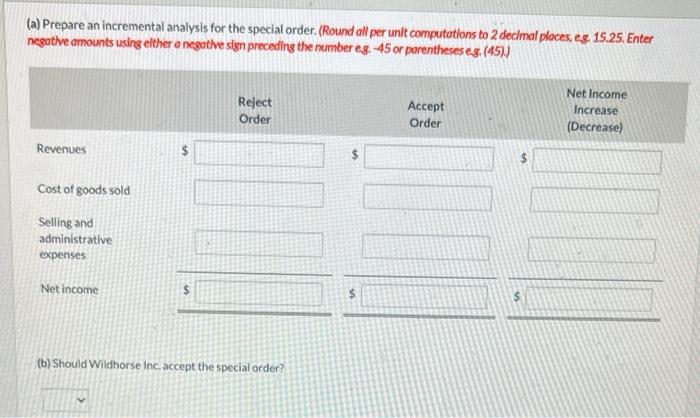

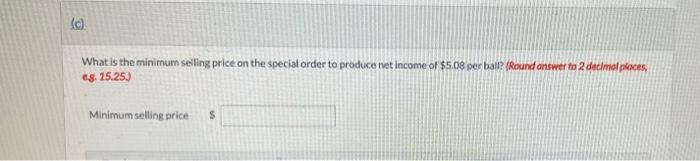

View Policies Current Attempt in Progress Wildhorse Inc. manufactures basketballs for the Women's National Basketball Association (WNBA). For the first 6 months of 2022, the company reported the following operating results while operating at 80% of plant capacity and producing 119,900 units. Amount $4,676,100 3,569,024 Sales Cost of goods sold Selling and administrative expenses Net income 443,437 $663,639 Fixed costs for the period were cost of goods sold $960,000, and selling and administrative expenses $248.000 In July, normally a slack manufacturing month. Wildhorse receives a special order for 10,000 basketballs at $28 each from the Greek Basketball Association (GBA). Acceptance of the order would increase variable selling and administrative expenses $0.76 per unit because of shipping costs but would not increase fixed costs and expenses. (a) Prepare an incremental analysis for the special order. (Round all per unit computations to 2 decimal places, eg: 15.25. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg: (45)) Reject Order Accept Order Net Income Increase (Decrease) Revenues $ Cost of goods sold Selling and administrative expenses Net income $ $ $ (b) Should Wildhorse Inc accept the special order? (c). What is the minimum selling price on the special order to produce net income of $5.08 per ball? (Round answer to 2 decimal places, es. 15.25.) Minimum selling price s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts