Question: 1) With the data in the Example, check whether Interest Rate Parity (IRP) is holding. Show all your calculations. Discuss implication of IRP is holding

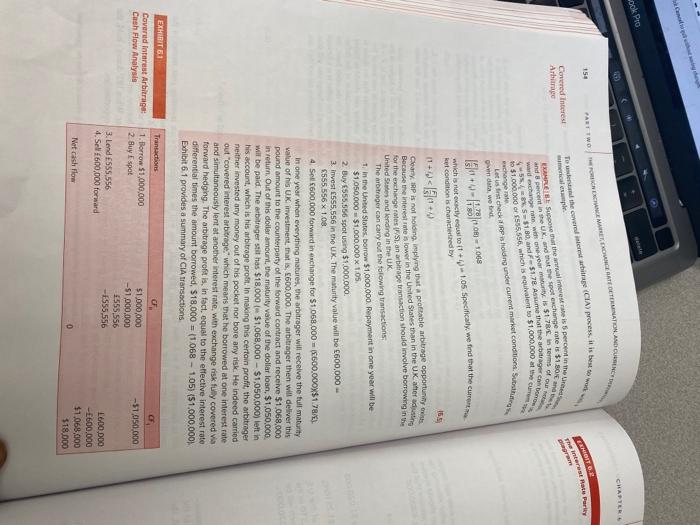

ook Pro CHAPTER 150 EGITOR The interest Paris Covered interest Arbitre mesme per FANART RATE DETERNATOR AND OUR To the arbitrage (CIA) Process is best to work EXAMPLE Suose the percent in the US and in the UK, and to change rate is $10 ward change rate writy is $1. in terms of 515179 Assume that the 155555hich count $1.000.000 Laturist check pisodig under current market conditions. Su change rate en dat we 11.78 1180 + 1010 which is not to il 105 Spesiell we find that the cu ket condition is characterized by 155 ChryRP is not holding implying that a profitable arbitrage opportunity to for the exchange rates 65 an abitrage transaction should involve borrowing into Beroute the interest rate blower in the United States tran in the UK aneth United States and lending in the UK The arbitrager can carry out the folowing transactions 1. In the United States, borrow $1.000.000. Repayment in one year will be $1.050.000 $1.000.000 x 1.05 2. Buy (555.556 spot using $1.000.000 2. Invest $55.556 in the UK. The maturity value will be 600,000 5555.556 X 1.08 4. Sol 600.000 forward in exchange for $1.068,000 $600.000$$1.78/). In one year when everything matures, the arbitrager will receive the full maturity value of his UK investment, that is, 600,000. The arbitrager then will deliver this pound amount to the counterparty of the forward contract and receive $1.068,000 in return Out of this dollar amount, the maturity value of the dollar loan $1,050,000 will be paid. The arbitrager still has $18,000 $1.068,000 - $1,050.000) left in his account, which is his arbitrage profit. In making this certain profit the arbitrager neither invested any money out of his pocket nor bore any risk. He indeed carried outcovered interest arbitrage, which means that he borrowed at one interest rate and simultaneously lent at another interest rate with exchange risk fully covered via forward hedging. The arbitrage profit is, in fact, equal to the effective interest rate differentiat times the amount borrowed, $18.000 = (1 068 - 1.05) (51.000.000) Exhibit 6.1 provides a summary of CIA transactions EXHIRT 1 Covered interest Arbitrage Cash Flow Analysis Transactions 1. Borrow $1,000,000 2. Buy E spot CF $1,000,000 -51.000.000 555.556 -E555,556 CF -51.050,000 3. Lend E555,556 4. Sel 600,000 forward L600,000 -600,000 11.068,000 $18.000 Net cash flow ook Pro CHAPTER 150 EGITOR The interest Paris Covered interest Arbitre mesme per FANART RATE DETERNATOR AND OUR To the arbitrage (CIA) Process is best to work EXAMPLE Suose the percent in the US and in the UK, and to change rate is $10 ward change rate writy is $1. in terms of 515179 Assume that the 155555hich count $1.000.000 Laturist check pisodig under current market conditions. Su change rate en dat we 11.78 1180 + 1010 which is not to il 105 Spesiell we find that the cu ket condition is characterized by 155 ChryRP is not holding implying that a profitable arbitrage opportunity to for the exchange rates 65 an abitrage transaction should involve borrowing into Beroute the interest rate blower in the United States tran in the UK aneth United States and lending in the UK The arbitrager can carry out the folowing transactions 1. In the United States, borrow $1.000.000. Repayment in one year will be $1.050.000 $1.000.000 x 1.05 2. Buy (555.556 spot using $1.000.000 2. Invest $55.556 in the UK. The maturity value will be 600,000 5555.556 X 1.08 4. Sol 600.000 forward in exchange for $1.068,000 $600.000$$1.78/). In one year when everything matures, the arbitrager will receive the full maturity value of his UK investment, that is, 600,000. The arbitrager then will deliver this pound amount to the counterparty of the forward contract and receive $1.068,000 in return Out of this dollar amount, the maturity value of the dollar loan $1,050,000 will be paid. The arbitrager still has $18,000 $1.068,000 - $1,050.000) left in his account, which is his arbitrage profit. In making this certain profit the arbitrager neither invested any money out of his pocket nor bore any risk. He indeed carried outcovered interest arbitrage, which means that he borrowed at one interest rate and simultaneously lent at another interest rate with exchange risk fully covered via forward hedging. The arbitrage profit is, in fact, equal to the effective interest rate differentiat times the amount borrowed, $18.000 = (1 068 - 1.05) (51.000.000) Exhibit 6.1 provides a summary of CIA transactions EXHIRT 1 Covered interest Arbitrage Cash Flow Analysis Transactions 1. Borrow $1,000,000 2. Buy E spot CF $1,000,000 -51.000.000 555.556 -E555,556 CF -51.050,000 3. Lend E555,556 4. Sel 600,000 forward L600,000 -600,000 11.068,000 $18.000 Net cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts