Question: 1. Wkst 2-2: form 1040 Name Date Period Directions: Using the 1040 and tax tables, answer the following questions. Eleanor is single and makes

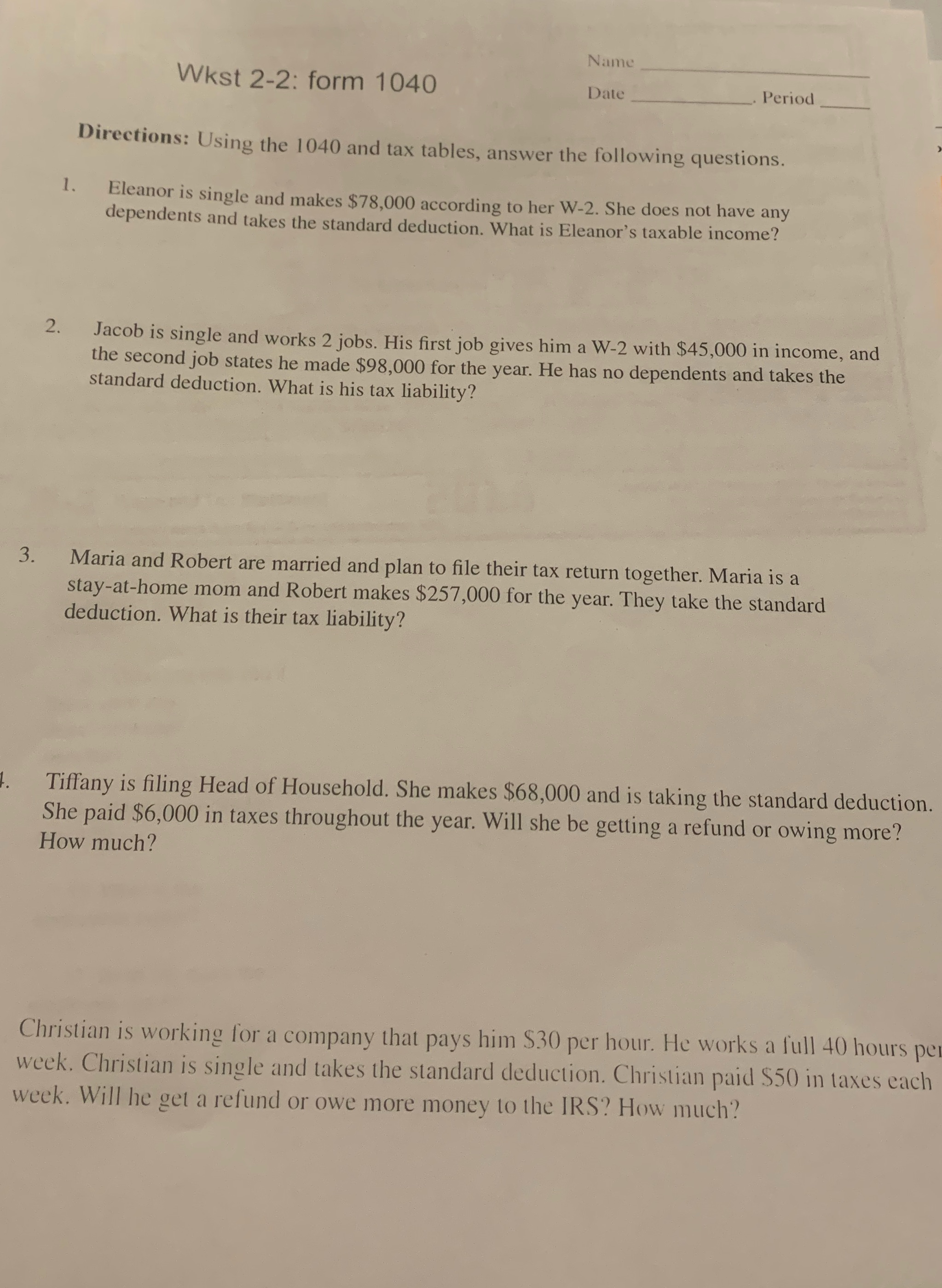

1. Wkst 2-2: form 1040 Name Date Period Directions: Using the 1040 and tax tables, answer the following questions. Eleanor is single and makes $78,000 according to her W-2. She does not have any dependents and takes the standard deduction. What is Eleanor's taxable income? 2. Jacob is single and works 2 jobs. His first job gives him a W-2 with $45,000 in income, and the second job states he made $98,000 for the year. He has no dependents and takes the standard deduction. What is his tax liability? 3. Maria and Robert are married and plan to file their tax return together. Maria is a stay-at-home mom and Robert makes $257,000 for the year. They take the standard deduction. What is their tax liability? 1. Tiffany is filing Head of Household. She makes $68,000 and is taking the standard deduction. She paid $6,000 in taxes throughout the year. Will she be getting a refund or owing more? How much? Christian is working for a company that pays him $30 per hour. He works a full 40 hours per week. Christian is single and takes the standard deduction. Christian paid $50 in taxes each week. Will he get a refund or owe more money to the IRS? How much?

Step by Step Solution

There are 3 Steps involved in it

Answer 1 Eleanors taxable income can be calculated as follows Total Income 78000 Standard Deduction ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642a8282062b_976709.pdf

180 KBs PDF File

6642a8282062b_976709.docx

120 KBs Word File