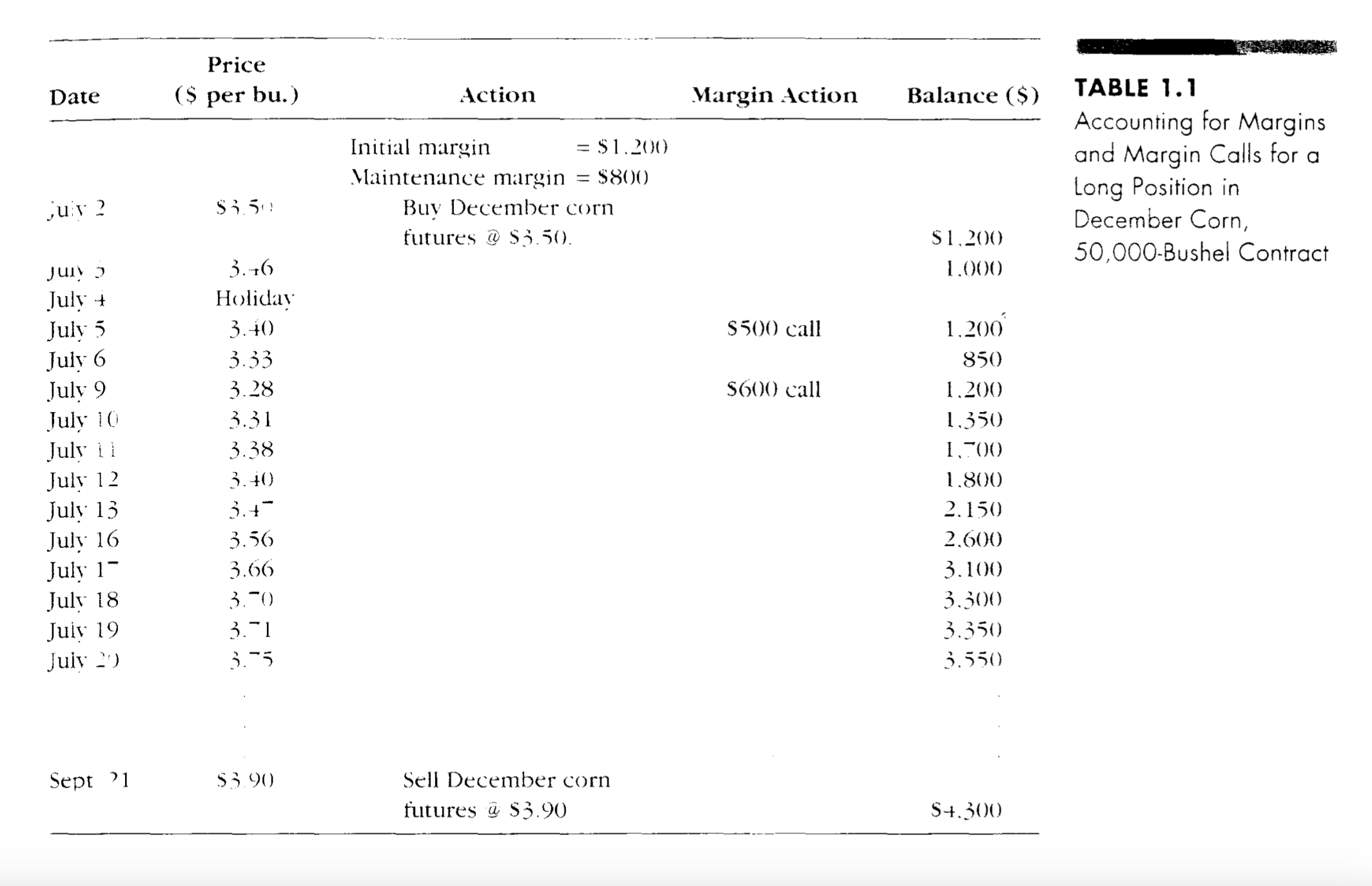

Question: 1) Work maintenance account example in Purcell and Koontz, Chapter 1, Table 1.1, page 7. Do not use the margin requirements in the table. Use

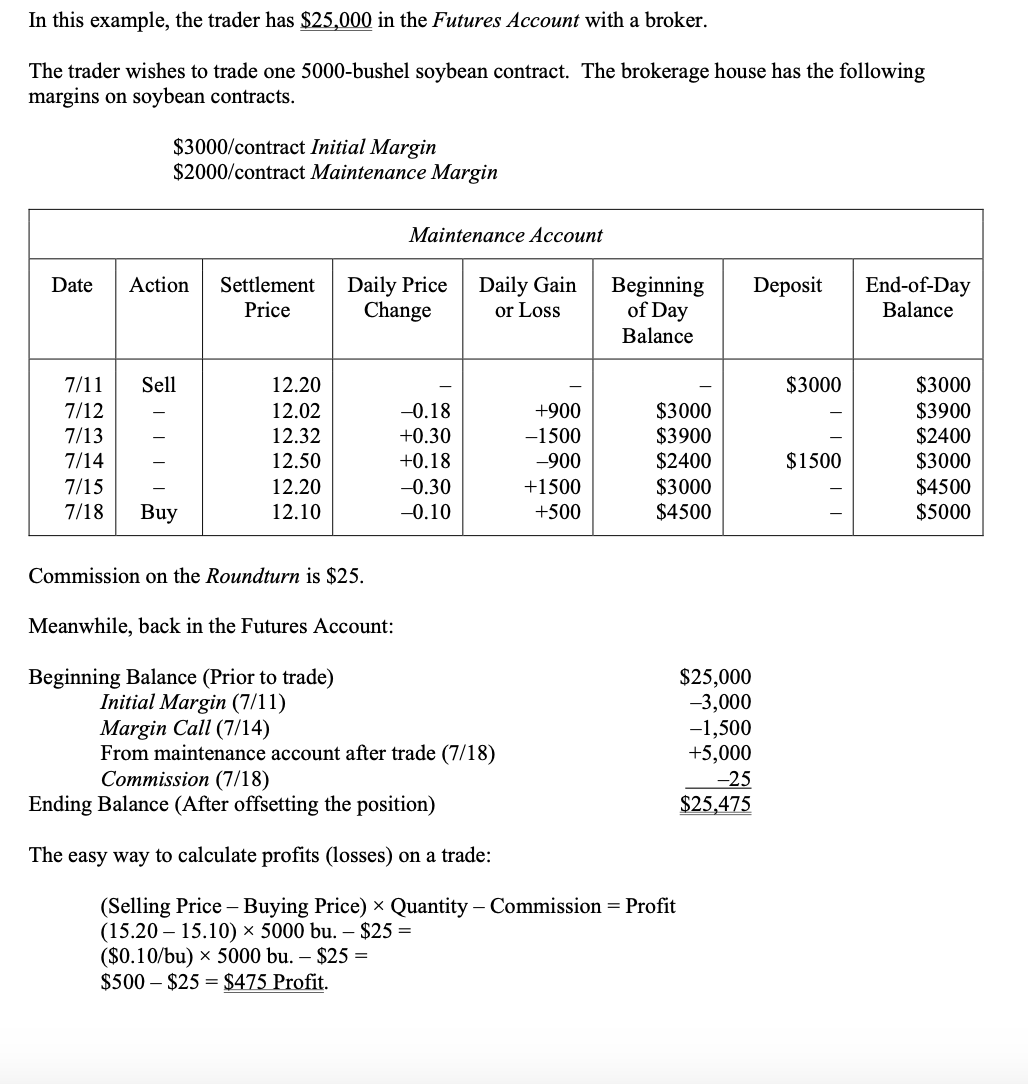

1) Work maintenance account example in Purcell and Koontz, Chapter 1, Table 1.1, page 7. Do not use the margin requirements in the table. Use $1,200 for the initial margin and $800 for the maintenance margin. Your spreadsheet should look like the "Marking to Market" Handout. But it is recommended that you add a column for the quantity traded. (A) Assume you trade five contracts. Assume you enter each trade at the market close. (B) Write a short summary on the spreadsheet page. Do not describe every step that you performed. Summarize what makes the calculations in this quiz different from the material in the text. (C) What are you assuming by jumping from July to September? (D) Please note there is a problem with the book table. It is a typo. What is it?

2) Work the maintenance account on a second spreadsheet page where you trade two contracts. You buy the first contract, as before and on the table, on July 2. Assume you buy the second contract at the close on July 3. Then assume you sell one contract back at the close on July 17 and, as in the table, sell the remaining contract on Sep 21. Again, assume you get out of the trade at the market closing price. This assumption will impact the quantity so be careful and think. Complete your work on a single spreadsheet. The maintenance account dollars for all corn contracts are kept in a single account. In other words, do not split the contracts out separately in your spreadsheet. Use $1,200 per contract for the initial margin and $800 per contract for the maintenance margin. Also make the following assumptions. (A) Assume your broker makes you put up enough initial margin on the additional trades to cover the initial margin on all open contracts. (B) Assume you leave the money in your maintenance account after liquidating any of your long positions. You will not but (C) does it matter which contract you sell first? Offer proof and not just opinion. (Yes, FIFO will be used but, does it matter?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts