Question: 1) Write a function to calculate the future value of a lump sum called FVCalc(deposit, t, LIBOR). For your three inputs: 1) Deposit will be

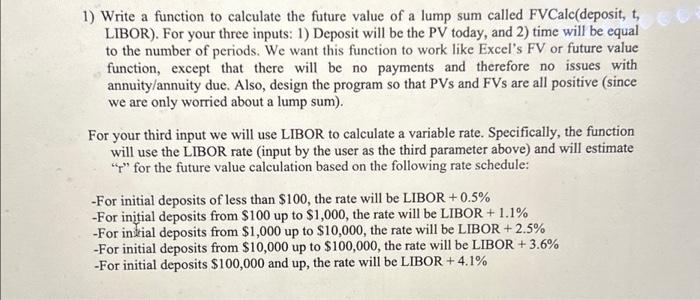

1) Write a function to calculate the future value of a lump sum called FVCalc(deposit, t, LIBOR). For your three inputs: 1) Deposit will be the PV today, and 2) time will be equal to the number of periods. We want this function to work like Excel's FV or future value function, except that there will be no payments and therefore no issues with annuity/annuity due. Also, design the program so that PVs and FVs are all positive (since we are only worried about a lump sum). For your third input we will use LIBOR to calculate a variable rate. Specifically, the function will use the LIBOR rate (input by the user as the third parameter above) and will estimate " r " for the future value calculation based on the following rate schedule: -For initial deposits of less than $100, the rate will be LIBOR+0.5% -For initial deposits from $100 up to $1,000, the rate will be LIBOR +1.1% -For in -For initial deposits from $10,000 up to $100,000, the rate will be LIBOR +3.6% -For initial deposits $100,000 and up, the rate will be LIBOR +4.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts