Question: 1) Write out each Journal Entry for these transactions. 2) Post the manufacturing entries in T-accounts provided. 3) We need the WIP OverHead allocation Journal

| 1) Write out each Journal Entry for these transactions. | |||||||||

| 2) Post the manufacturing entries in T-accounts provided. | |||||||||

| 3) | We need the WIP OverHead allocation Journal Entry, | ||||||||

| the Finished Goods JE, COGS JE, Revenue JE, and the final OH reconciliation JE. Provide calculations if needed. | |||||||||

| Post these to T-accounts as well. | |||||||||

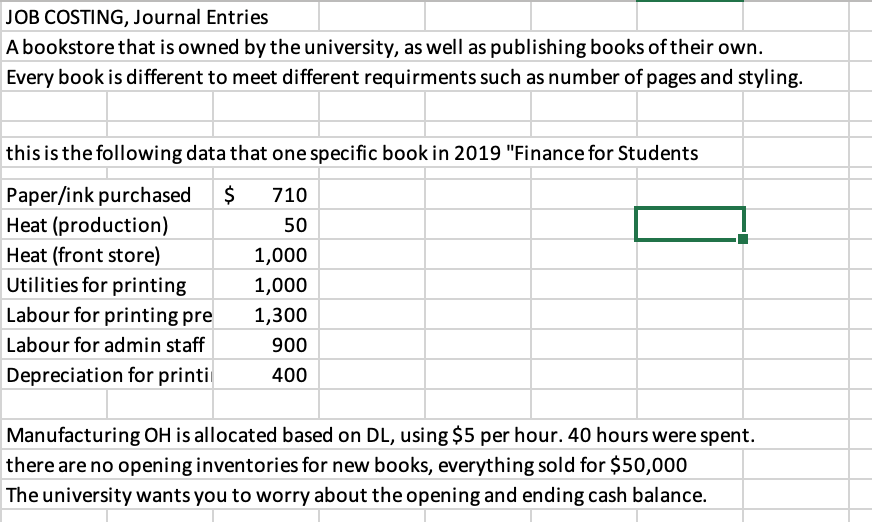

JOB COSTING, Journal Entries A bookstore that is owned by the university, as well as publishing books of their own. Every book is different to meet different requirments such as number of pages and styling. this is the following data that one specific book in 2019 "Finance for Students Paper/ink purchased $ Heat (production) Heat (front store) Utilities for printing Labour for printing pre Labour for admin staff Depreciation for printi 710 50 1,000 1,000 1,300 900 400 Manufacturing OH is allocated based on DL, using $5 per hour. 40 hours were spent. there are no opening inventories for new books, everything sold for $50,000 The university wants you to worry about the opening and ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts