Question: 1. Write the regression equcation? (5 Marks) 2. Assuming everything else being kept constant, if VRP were to increase by 0.5 unit, what is the

1. Write the regression equcation? (5 Marks)

2. Assuming everything else being kept constant, if VRP were to increase by 0.5 unit, what is the expected impact to next month's return? (5 Marks)

solve all four part of this question

two part in picture and pending two part is written

best of luck

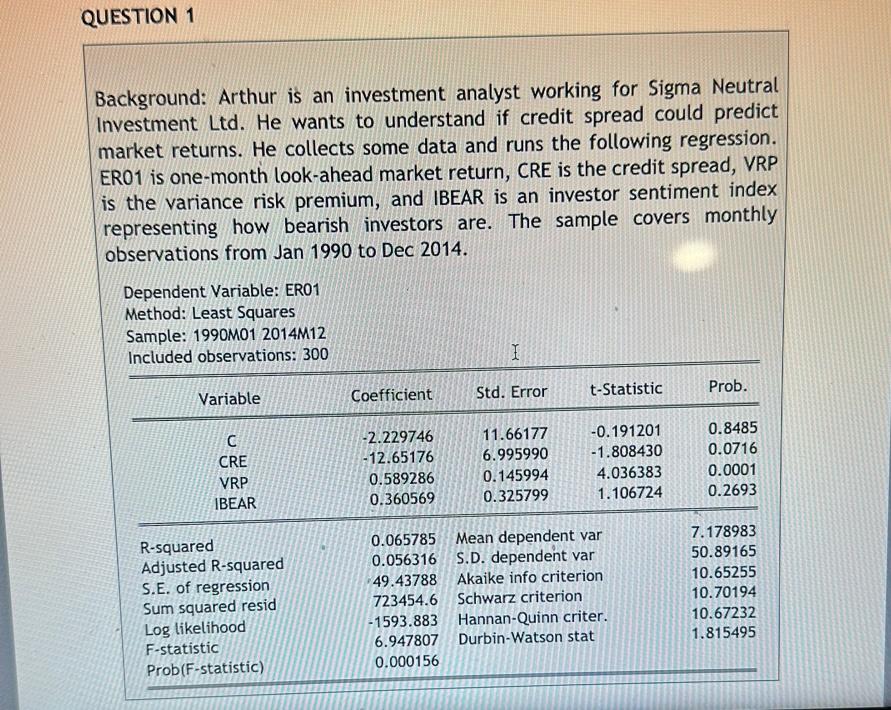

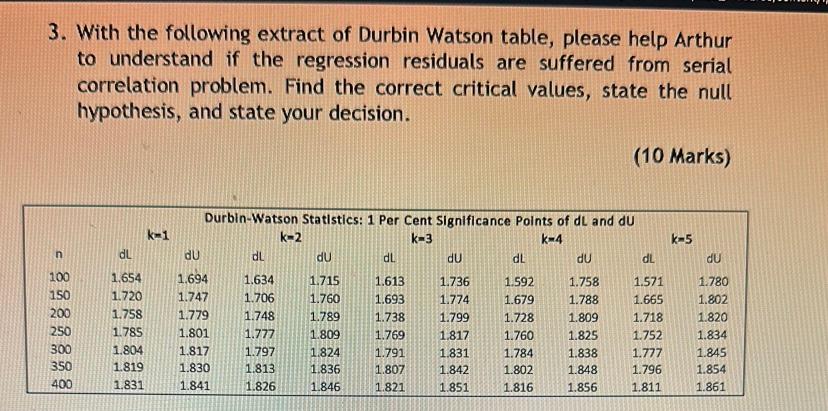

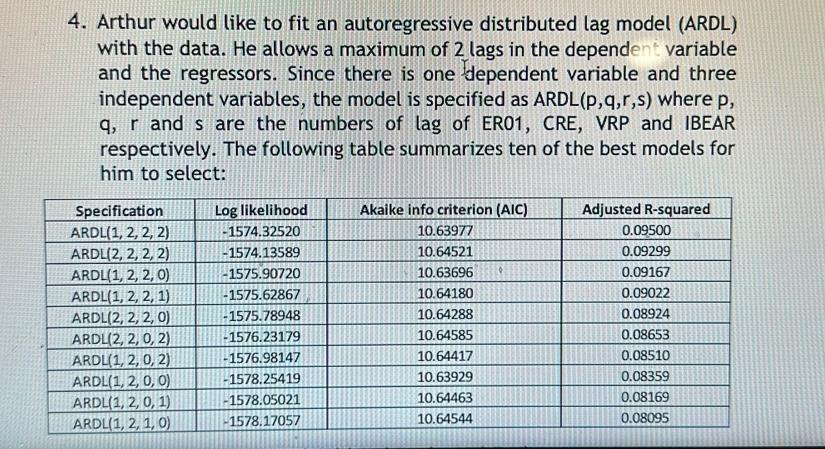

Background: Arthur is an investment analyst working for Sigma Neutral Investment Ltd. He wants to understand if credit spread could predict market returns. He collects some data and runs the following regression. ER01 is one-month look-ahead market return, CRE is the credit spread, VRP is the variance risk premium, and IBEAR is an investor sentiment index representing how bearish investors are. The sample covers monthly observations from Jan 1990 to Dec 2014. Dependent Variable: ER01 Method: Least Squares Sample: 1990M012014M12 3. With the following extract of Durbin Watson table, please help Arthur to understand if the regression residuals are suffered from serial correlation problem. Find the correct critical values, state the null hypothesis, and state your decision. 4. Arthur would like to fit an autoregressive distributed lag model (ARDL) with the data. He allows a maximum of 2 lags in the dependent variable and the regressors. Since there is one dependent variable and three independent variables, the model is specified as ARDL(p,q,r,s) where p, q,r and s are the numbers of lag of ER01, CRE, VRP and IBEAR respectively. The following table summarizes ten of the best models for him to select: Background: Arthur is an investment analyst working for Sigma Neutral Investment Ltd. He wants to understand if credit spread could predict market returns. He collects some data and runs the following regression. ER01 is one-month look-ahead market return, CRE is the credit spread, VRP is the variance risk premium, and IBEAR is an investor sentiment index representing how bearish investors are. The sample covers monthly observations from Jan 1990 to Dec 2014. Dependent Variable: ER01 Method: Least Squares Sample: 1990M012014M12 3. With the following extract of Durbin Watson table, please help Arthur to understand if the regression residuals are suffered from serial correlation problem. Find the correct critical values, state the null hypothesis, and state your decision. 4. Arthur would like to fit an autoregressive distributed lag model (ARDL) with the data. He allows a maximum of 2 lags in the dependent variable and the regressors. Since there is one dependent variable and three independent variables, the model is specified as ARDL(p,q,r,s) where p, q,r and s are the numbers of lag of ER01, CRE, VRP and IBEAR respectively. The following table summarizes ten of the best models for him to select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts