Question: 1 . X , Y and Z form a general partnership with cash contributions of $ 5 0 , 0 0 0 , $ 5

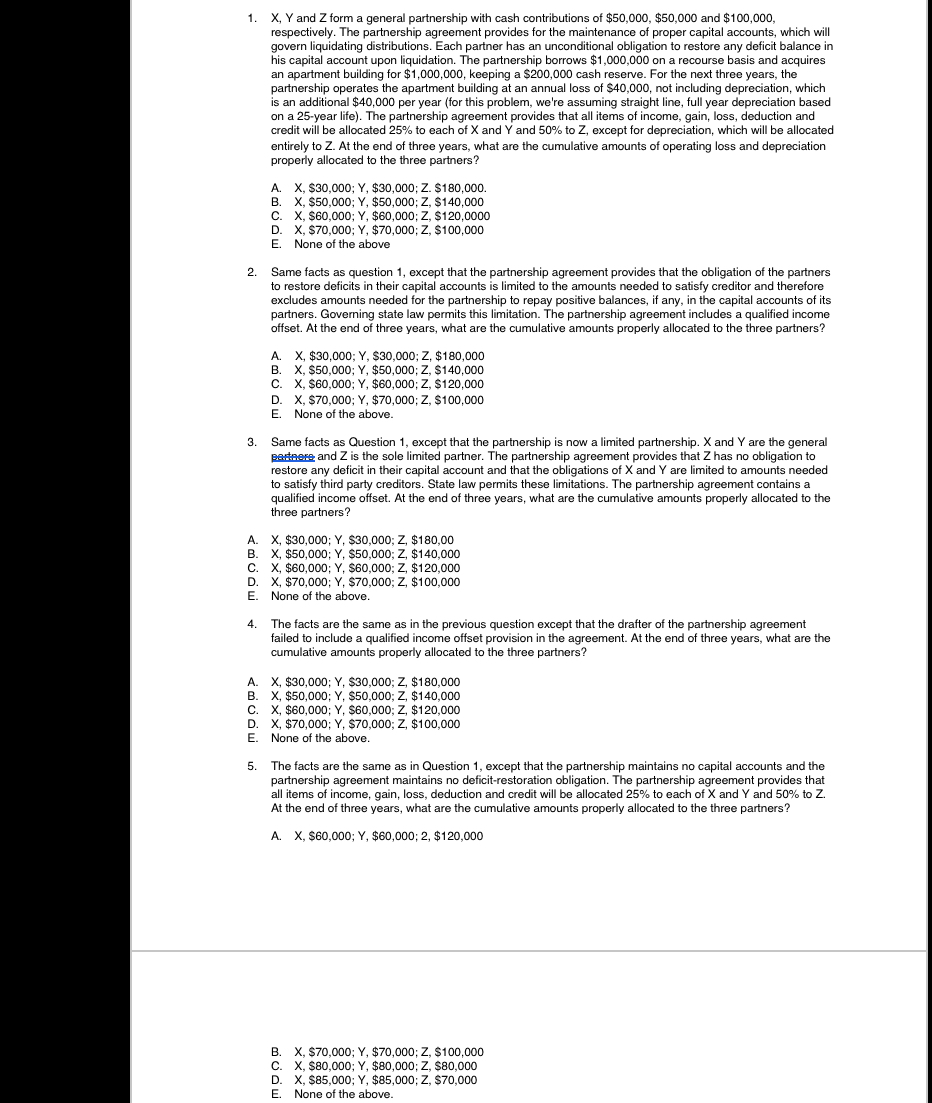

X Y and Z form a general partnership with cash contributions of $ $ and $ respectively. The partnership agreement provides for the maintenance of proper capital accounts, which will govern liquidating distributions. Each partner has an unconditional obligation to restore any deficit balance in his capital account upon liquidation. The partnership borrows $ on a recourse basis and acquires an apartment building for $ keeping a $ cash reserve. For the next three years, the partnership operates the apartment building at an annual loss of $ not including depreciation, which is an additional $ per year for this problem, we're assuming straight line, full year depreciation based on a year life The partnership agreement provides that all items of income, gain, loss, deduction and credit will be allocated to each of X and Y and to Z except for depreciation, which will be allocated entirely to Z At the end of three years, what are the cumulative amounts of operating loss and depreciation properly allocated to the three partners?

A X $; Y $; Z $

B X $; Y $; Z $

C X $; Y $; Z $

D X $; Y $; Z $

E None of the above

Same facts as question except that the partnership agreement provides that the obligation of the partners to restore deficits in their capital accounts is limited to the amounts needed to satisfy creditor and therefore excludes amounts needed for the partnership to repay positive balances, if any, in the capital accounts of its partners. Governing state law permits this limitation The partnership agreement includes a qualified income offset. At the end of three years, what are the cumulative amounts properly allocated to the three partners?

AX $; Y $; Z $

B X $; Y $; Z $

C X $; Y $; Z $

D X $; Y $; Z $

E None of the above.

Same facts as Question except that the partnership is now a limited partnership. X and Y are the general partners and Z is the sole limited partner. The partnership agreement provides that Z has no obligation to restore any deficit in their capital account and that the obligations of X and Y are limited to amounts needed to satisfy third party creditors. State law permits these limitations The partnership agreement contains a qualified income offset. At the end of three years, what are the cumulative amounts properly allocated to the three partners?

A X $; Y $; Z $

B X $; Y $; Z $

C X $; Y $; Z $

D X $; Y $; Z $

E None of the above.

The facts are the same as in the previous question except that the drafter of the partnership agreement failed to include a qualified income offset provision in the agreement. At the end of three years, what are the cumulative amounts properly allocated to the three partners?

A X $; Y $; Z $

B X $; Y $; Z $

C X $; Y $; Z $

D X $; Y $; Z $

E None of the above.

The facts are the same as in Question except that the partnership maintains no capital accounts and the partnership agreement maintains no deficitrestoration obligation. The partnership agreement provides that all items of income, gain, loss, deduction and credit will be allocated to each of X and Y and to Z At the end of three years, what are the cumulative amounts properly allocated to the three partners?

A X $; Y $; $

B X $; Y $; Z $

C X $; Y $; Z $

D X $; Y $; Z $

E None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock