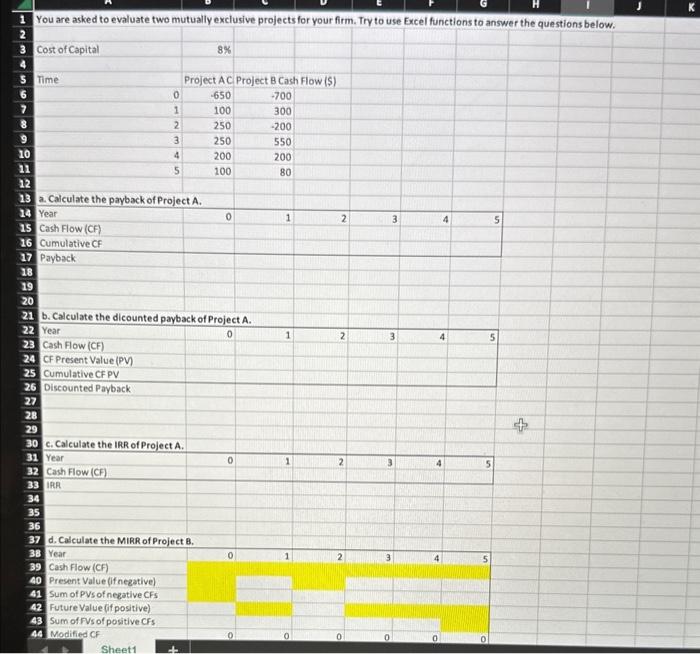

Question: 1 You are asked to evaluate two mutually exclusive projects for your firm. Try to use Excel functions to answer the questions below. 27 2928

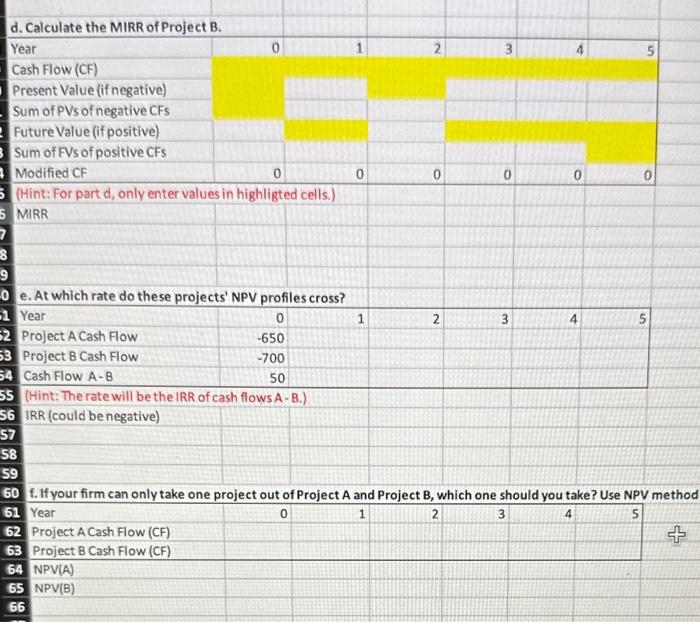

1 You are asked to evaluate two mutually exclusive projects for your firm. Try to use Excel functions to answer the questions below. 27 2928 c. Calculate the IRR of Project A. 32 Cash Flow (CF) 0 1 2 33 IR 34 35 36 37 d. Calculate the MiRR of Project B. 38 Year 39 Cash flow (CF) 40 Present Value (if negative) 41 Sum of Pys of negative CFs 42 Future Value (if positive) 43 Sum of 4 ss of positive CFs 44 Modified CF 0 1 2 3 3 5 d. Calculate the MIRR of Project B. Year 0 1 2 3 5 Cash Flow (CF) Present Value (if negative) Sum of PVs of negative CFs Future Value (if positive) Sum of FVs of positive CFs Modified CF (Hint: For part d, only enter values in highligted cells.) MIRR e. At which rate do these projects' NPV profiles cross? (Hint: The rate will be the IRR of cash flows A-B.) IRR (could be negative) f. If your firm can only take one project out of Project A and Project B, which one should you take? Use NPV method Year 01 2 3 4 Project A Cash Flow (CF) Project B Cash Flow (CF) NPV(A) NPV(B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts