Question: 1 . You are helping a manager calculate the present value a single cash - flow at the end of the year. Based on your

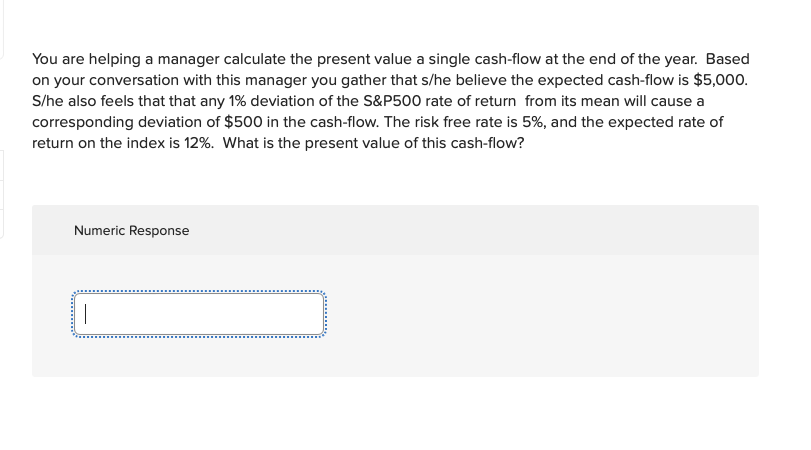

You are helping a manager calculate the present value a single cashflow at the end of the year. Based

on your conversation with this manager you gather that she believe the expected cashflow is $

She also feels that that any deviation of the S&P rate of return from its mean will cause a

corresponding deviation of $ in the cashflow. The risk free rate is and the expected rate of

return on the index is What is the present value of this cashflow?

For the data of the previous question, what the project cost of capital?

Consider a project that will have the previous cashflowsevery year in perpetuity,The initial investment is

$ What is the NPV

Repeat the previous problem, but this time assume that the project will generats only annual cash flows.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock