Question: 1. You are planning to create a portfolio from Lockheed Martin Corp. and Intel Corp., but first need to determine the required (expected) return for

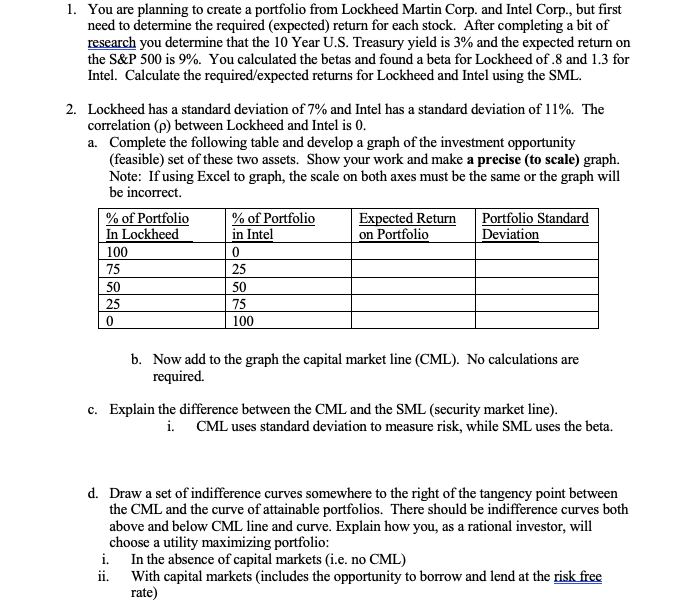

1. You are planning to create a portfolio from Lockheed Martin Corp. and Intel Corp., but first need to determine the required (expected) return for each stock. After completing a bit of research you determine that the 10 Year U.S. Treasury yield is 3% and the expected return on the S&P 500 is 9%. You calculated the betas and found a beta for Lockheed of .8 and 1.3 for Intel. Calculate the required/expected returns for Lockheed and Intel using the SML. 2. Lockheed has a standard deviation of 7% and Intel has a standard deviation of 1 1%. The correlation (p) between Lockheed and Intel is 0 a. Complete the following table and develop a graph of the investment opportunity (feasible) set of these two assets. Show your work and make a precise (to scale) graph. Note: If using Excel to graph, the scale on both axes must be the same or the graph will be incorrect. % of Portfolio In Lockheed 100 75 50 25 % of Portfolio in Intel Expected Return Portfolio Standard on Portfolico Deviation 25 50 75 100 b. Now add to the graph the capital market line (CML). No calculations are required. c. Explain the difference between the CML and the SML (security market line) i. CML uses standard deviation to measure risk, while SML uses the beta. d. Draw a set of indifference curves somewhere to the right of the tangency point between the CML and the curve of attainable portfolios. There should be indifference curves both above and below CML line and curve. Explain how you, as a rational investor, will choose a utility maximizing portfolio i. In the absence of capital markets (i.e. no CML) ii. With capital markets (includes the opportunity to borrow and lend at the risk free rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts