Question: 1) You are trying to save to buy a new $95,000 BMW X5 SUV. You have $85,000 today that can be invested at your bank.

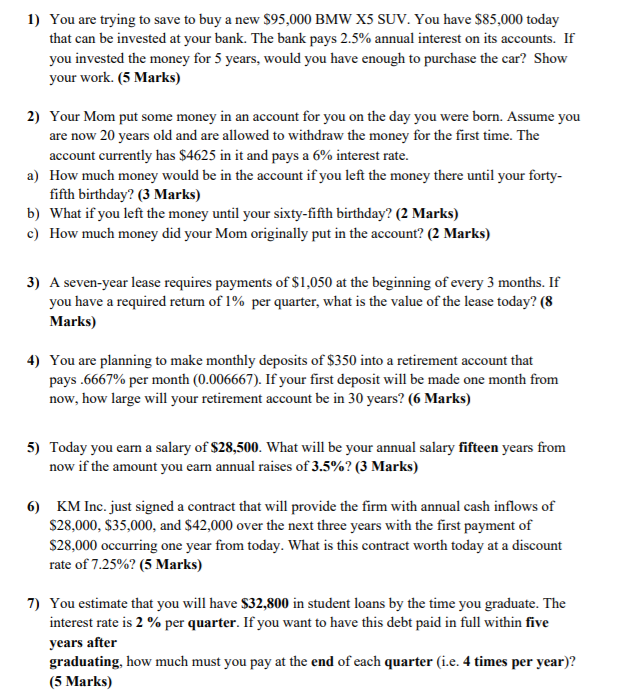

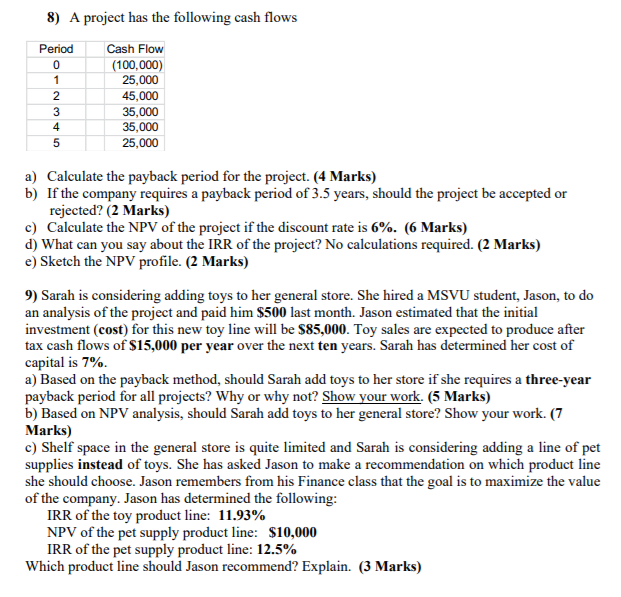

1) You are trying to save to buy a new $95,000 BMW X5 SUV. You have $85,000 today that can be invested at your bank. The bank pays 2.5% annual interest on its accounts. If you invested the money for 5 years, would you have enough to purchase the car? Show your work. (5 Marks) 2) Your Mom put some money in an account for you on the day you were born. Assume you are now 20 years old and are allowed to withdraw the money for the first time. The account currently has $4625 in it and pays a 6% interest rate. a) How much money would be in the account if you left the money there until your forty- fifth birthday? (3 Marks) b) What if you left the money until your sixty-fifth birthday? (2 Marks) c) How much money did your Mom originally put in the account? (2 Marks) 3) A seven-year lease requires payments of $1,050 at the beginning of every 3 months. If you have a required return of 1% per quarter, what is the value of the lease today? (8 Marks) 4) You are planning to make monthly deposits of $350 into a retirement account that pays.6667% per month (0.006667). If your first deposit will be made one month from now, how large will your retirement account be in 30 years? (6 Marks) 5) Today you earn a salary of $28,500. What will be your annual salary fifteen years from now if the amount you earn annual raises of 3.5%? (3 Marks) 6) KM Inc. just signed a contract that will provide the firm with annual cash inflows of $28,000, $35,000, and $42,000 over the next three years with the first payment of $28,000 occurring one year from today. What is this contract worth today at a discount rate of 7.25%? (5 Marks) 7) You estimate that you will have $32,800 in student loans by the time you graduate. The interest rate is 2 % per quarter. If you want to have this debt paid in full within five years after graduating, how much must you pay at the end of each quarter (i.e. 4 times per year)? (5 Marks) 8) A project has the following cash flows Period 0 1 2 3 4 5 WN Cash Flow (100,000) 25,000 45,000 35,000 35,000 25,000 a) Calculate the payback period for the project. (4 Marks) b) If the company requires a payback period of 3.5 years, should the project be accepted or rejected? (2 Marks) c) Calculate the NPV of the project if the discount rate is 6%. (6 Marks) d) What can you say about the IRR of the project? No calculations required. (2 Marks) e) Sketch the NPV profile. (2 Marks) 9) Sarah is considering adding toys to her general store. She hired a MSVU student, Jason, to do an analysis of the project and paid him $500 last month. Jason estimated that the initial investment (cost) for this new toy line will be $85,000. Toy sales are expected to produce after tax cash flows of $15,000 per year over the next ten years. Sarah has determined her cost of capital is 7% a) Based on the payback method, should Sarah add toys to her store if she requires a three-year payback period for all projects? Why or why not? Show your work. (5 Marks) b) Based on NPV analysis, should Sarah add toys to her general store? Show your work. (7 Marks) c) Shelf space in the general store is quite limited and Sarah is considering adding a line of pet supplies instead of toys. She has asked Jason to make a recommendation on which product line she should choose. Jason remembers from his Finance class that the goal is to maximize the value of the company. Jason has determined the following: IRR of the toy product line: 11.93% NPV of the pet supply product line: $10,000 IRR of the pet supply product line: 12.5% Which product line should Jason recommend? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts