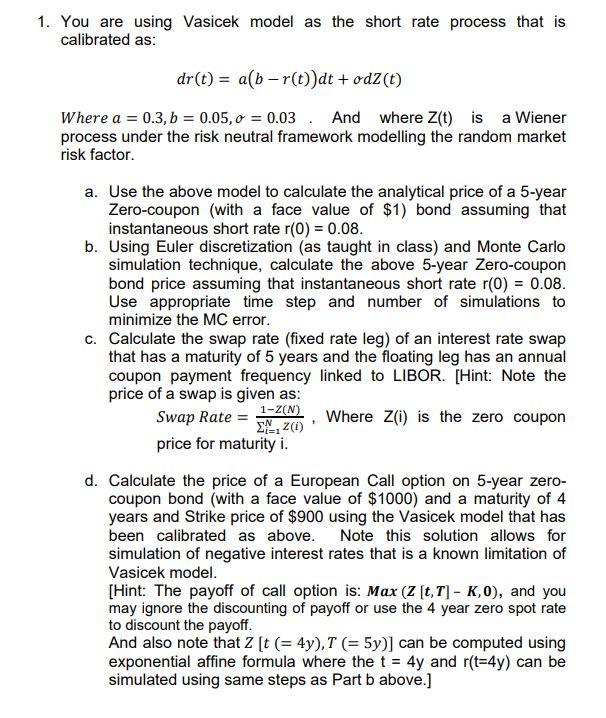

Question: 1. You are using Vasicek model as the short rate process that is calibrated as: dr(t) = alb r(t))dt + odZ(t) Where a = 0.3,

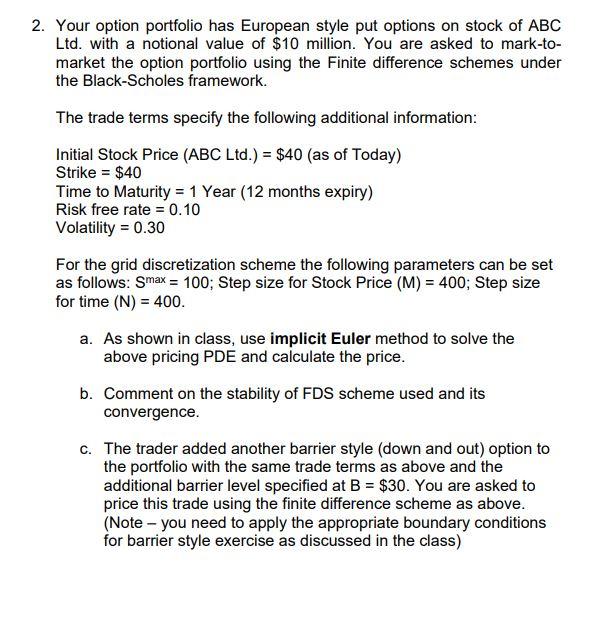

1. You are using Vasicek model as the short rate process that is calibrated as: dr(t) = alb r(t))dt + odZ(t) Where a = 0.3, b = 0.05,0 = 0.03. And where Z(t) is a Wiener process under the risk neutral framework modelling the random market risk factor. a. Use the above model to calculate the analytical price of a 5-year Zero-coupon (with a face value of $1) bond assuming that instantaneous short rate r(0) = 0.08. b. Using Euler discretization (as taught in class) and Monte Carlo simulation technique, calculate the above 5-year Zero-coupon bond price assuming that instantaneous short rate r(0) = 0.08. Use appropriate time step and number of simulations to minimize the MC error. c. Calculate the swap rate (fixed rate leg) of an interest rate swap that has a maturity of 5 years and the floating leg has an annual coupon payment frequency linked to LIBOR. (Hint: Note the price of a swap is given as: Where Z(i) is the zero coupon ,2(i) price for maturity i. d. Calculate the price of a European Call option on 5-year zero- coupon bond (with a face value of $1000) and a maturity of 4 years and Strike price of $900 using the Vasicek model that has been calibrated as above. Note this solution allows for simulation of negative interest rates that is a known limitation of Vasicek model. [Hint: The payoff of call option is: Max (Z [t,T] - K,0), and you may ignore the discounting of payoff or use the 4 year zero spot rate to discount the payoff. And also note that 2 [t (= 4y), T = 5y)] can be computed using exponential affine formula where the t = 4y and r(t=4y) can be simulated using same steps as part b above.] Swap Rate = 1-2(N) 2. Your option portfolio has European style put options on stock of ABC Ltd. with a notional value of $10 million. You are asked to mark-to- market the option portfolio using the Finite difference schemes under the Black-Scholes framework. The trade terms specify the following additional information: Initial Stock Price (ABC Ltd.) = $40 (as of Today) Strike = $40 Time to Maturity = 1 Year (12 months expiry) Risk free rate = 0.10 Volatility = 0.30 For the grid discretization scheme the following parameters can be set as follows: Smax = 100; Step size for Stock Price (M) = 400; Step size for time (N) = 400. a. As shown in class, use implicit Euler method to solve the above pricing PDE and calculate the price. b. Comment on the stability of FDS scheme used and its convergence. C. The trader added another barrier style (down and out) option to the portfolio with the same trade terms as above and the additional barrier level specified at B = $30. You are asked to price this trade using the finite difference scheme as above. (Note - you need to apply the appropriate boundary conditions for barrier style exercise as discussed in the class)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts