Question: 1. You have a fully amortizing level payment loan with an original principal amount of $100,000, an interest rate of 10% and a term of

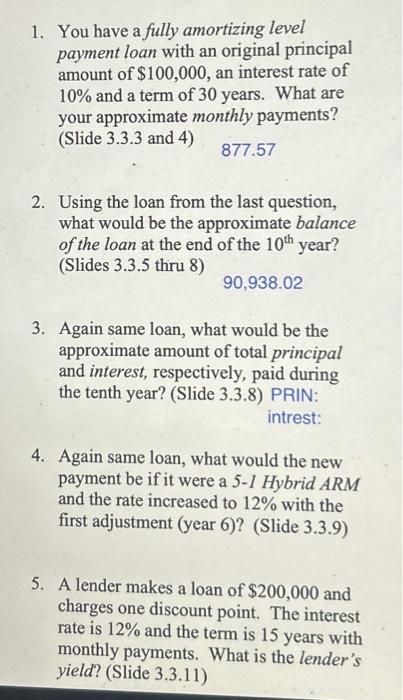

1. You have a fully amortizing level payment loan with an original principal amount of $100,000, an interest rate of 10% and a term of 30 years. What are your approximate monthly payments? (Slide 3.3.3 and 4) 877.57 2. Using the loan from the last question, what would be the approximate balance of the loan at the end of the 10th year? (Slides 3.3.5 thru 8) 90,938.02 3. Again same loan, what would be the approximate amount of total principal and interest, respectively, paid during the tenth year? (Slide 3.3.8) PRIN: intrest: 4. Again same loan, what would the new payment be if it were a 51 Hybrid ARM and the rate increased to 12% with the first adjustment (year 6)? (Slide 3.3.9) 5. A lender makes a loan of $200,000 and charges one discount point. The interest rate is 12% and the term is 15 years with monthly payments. What is the lender's yield? (Slide 3.3.11)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts