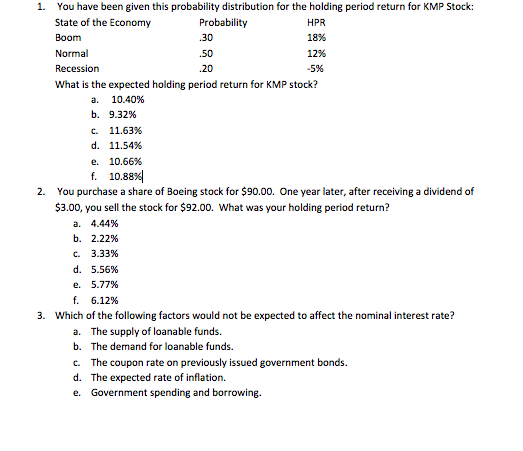

Question: 1. You have been given this probability distribution for the holding period return for KMP Stock State of the Economy Boom Normal Recession What is

1. You have been given this probability distribution for the holding period return for KMP Stock State of the Economy Boom Normal Recession What is the expected holding period return for KMP stock? Probability 30 .50 20 HPR 18% 12% 5% a. b. c. d. 10.40% 9.32% 11.63% 11.54% 10.66% 10.88%) f. You purchase a share of Boeing stock for $90.00. One year later, after receiving a dividend of $3.00, you sell the stock for $92.00. 2. What was your holding period return? a. b. c. d. e. 4.44% 2.22% 3.33% 5.56% 5.77% 6.12% 3. Which of the following factors would not be expected to affect the nominal interest rate? a. The supply of loanable funds. b. The demand for loanable funds. c. The coupon rate on previously issued government bonds. d. The expected rate of inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts