Question: 1. You have invested in stock A and B two years ago. The prices for stock A and B were $24, $10 respectably. Currently, the

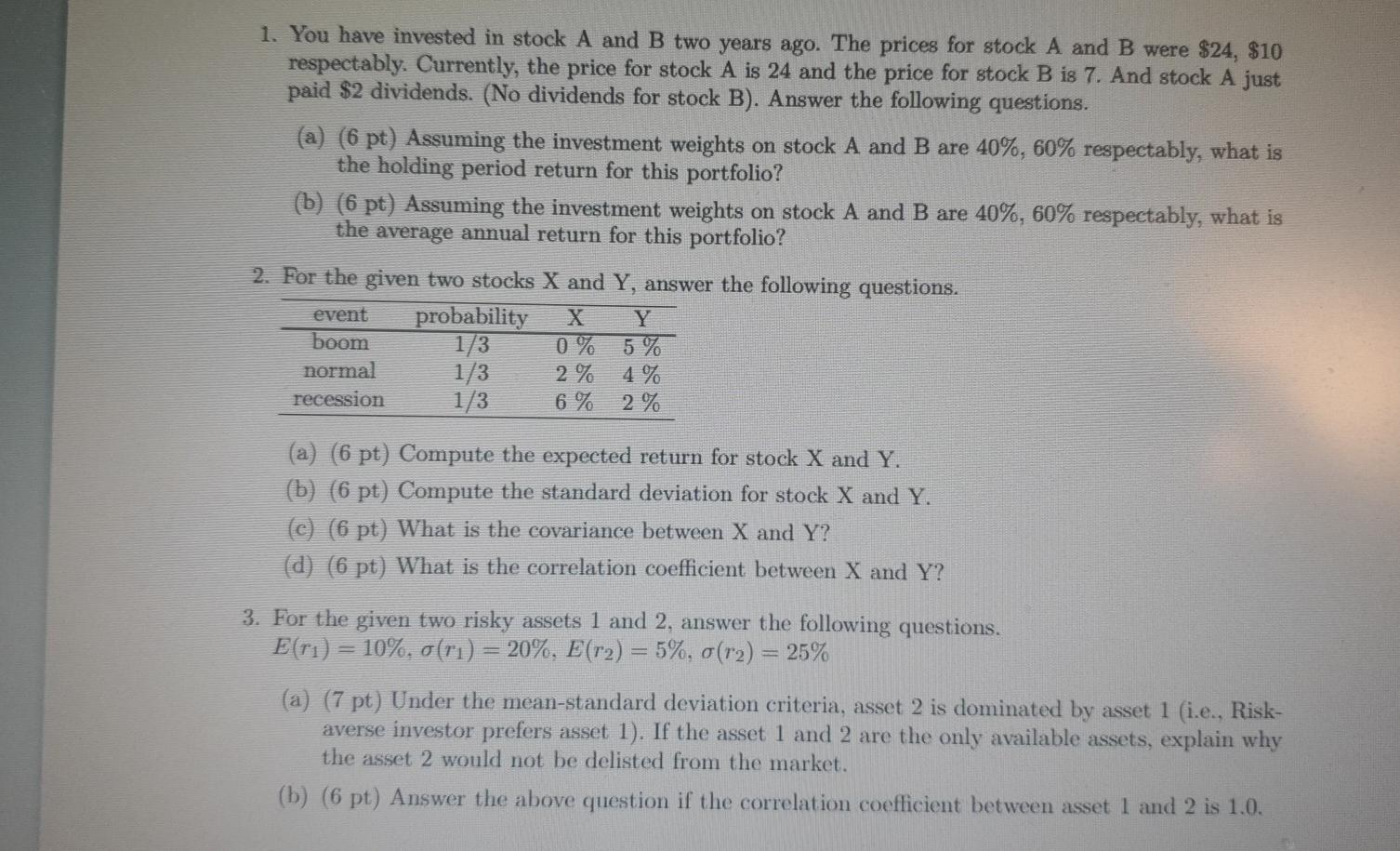

1. You have invested in stock A and B two years ago. The prices for stock A and B were $24, $10 respectably. Currently, the price for stock A is 24 and the price for stock B is 7. And stock A just paid $2 dividends. (No dividends for stock B). Answer the following questions. (a) (6 pt) Assuming the investment weights on stock A and B are 40%, 60% respectably, what is the holding period return for this portfolio? (b) (6 pt) Assuming the investment weights on stock A and B are 40%, 60% respectably, what is the average annual return for this portfolio? 2. For the given two stocks X and Y, answer the following questions. event probability Y boom 1/3 5 % normal 1/3 2 % 4 % recession 1/3 6% 2 % (a) (6 pt) Compute the expected return for stock X and Y. (b) (6 pt) Compute the standard deviation for stock X and Y. (c) (6 pt) What is the covariance between X and Y? (d) (6 pt) What is the correlation coefficient between X and Y? 3. For the given two risky assets 1 and 2, answer the following questions. E(r) = 10%, o(r) = 20%, E(r2) = 5%, o(r2) = 25% (a) (7 pt) Under the mean-standard deviation criteria, asset 2 is dominated by asset 1 (i.e., Risk- averse investor prefers asset 1). If the asset 1 and 2 are the only available assets, explain why the asset 2 would not be delisted from the market. (b) (6 pt) Answer the above question if the correlation coefficient between asset 1 and 2 is 1.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts