Question: 1. You have three different efficient markets and three different tools for your investments. Can you beat the given market using given strategy? Complete the

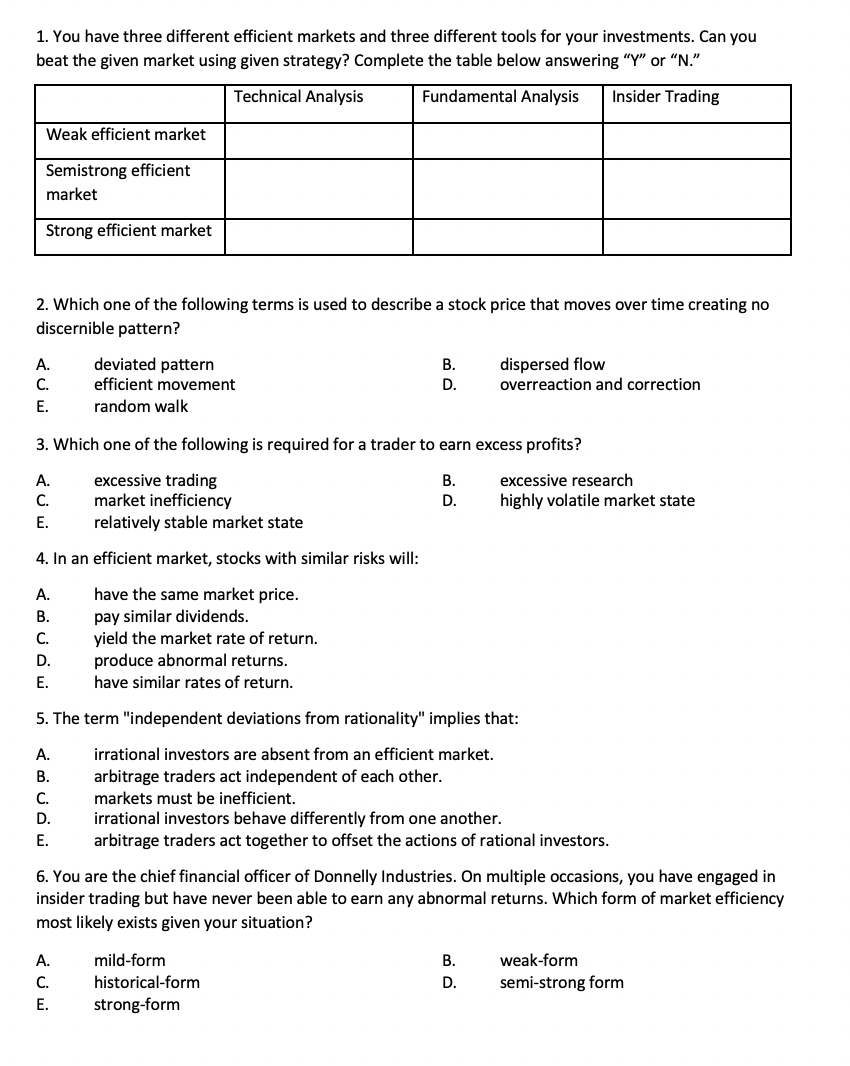

1. You have three different efficient markets and three different tools for your investments. Can you beat the given market using given strategy? Complete the table below answering "Y" or "N." Technical Analysis Fundamental Analysis | Insider Trading Weak efficient market Semistrong efficient market Strong efficient market 2. Which one of the following terms is used to describe a stock price that moves over time creating no discernible pattern? A. C. deviated pattern efficient movement random walk dispersed flow overreaction and correction 3. Which one of the following is required for a trader to earn excess profits? excessive trading market inefficiency relatively stable market state excessive research highly volatile market state 4. In an efficient market, stocks with similar risks will: due wi have the same market price. pay similar dividends. yield the market rate of return. produce abnormal returns. have similar rates of return. 5. The term "independent deviations from rationality" implies that: idud irrational investors are absent from an efficient market. arbitrage traders act independent of each other. markets must be inefficient. irrational investors behave differently from one another. arbitrage traders act together to offset the actions of rational investors. E. 6. You are the chief financial officer of Donnelly Industries. On multiple occasions, you have engaged in insider trading but have never been able to earn any abnormal returns. Which form of market efficiency most likely exists given your situation? mild-form historical-form strong-form weak-form semi-strong form uw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts