Question: 1. You own 2 bonds (A & B), each with a par value of $1,000. Bond A pays 8% interest annually; bond B accrues

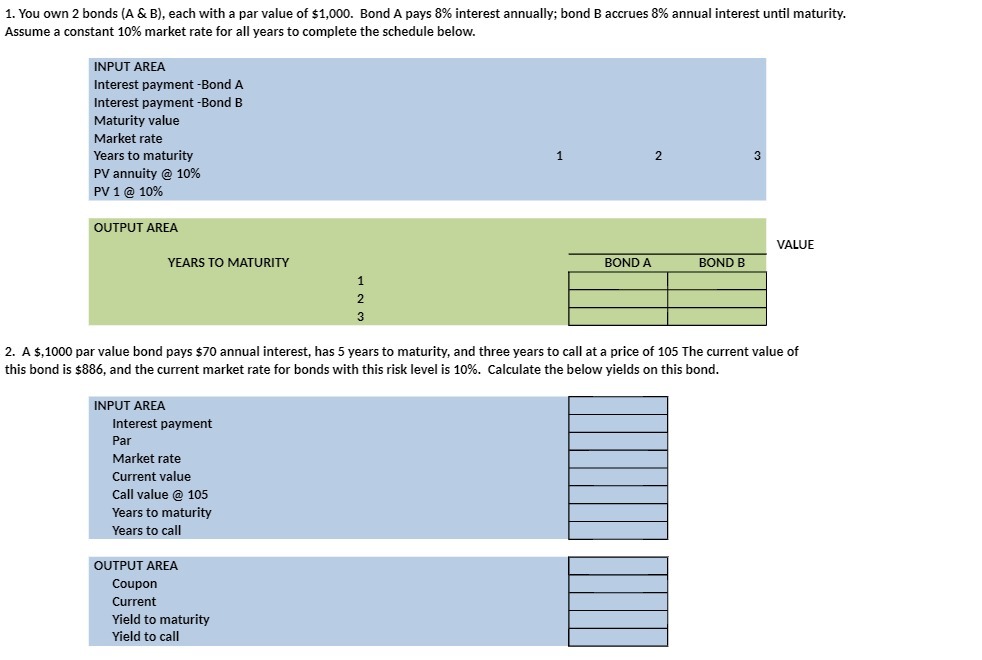

1. You own 2 bonds (A & B), each with a par value of $1,000. Bond A pays 8% interest annually; bond B accrues 8% annual interest until maturity. Assume a constant 10% market rate for all years to complete the schedule below. INPUT AREA Interest payment -Bond A Interest payment -Bond B Maturity value Market rate Years to maturity PV annuity @ 10% PV 1 @ 10% 3 2 OUTPUT AREA YEARS TO MATURITY 1 2 VALUE BOND A BOND B 2. A $,1000 par value bond pays $70 annual interest, has 5 years to maturity, and three years to call at a price of 105 The current value of this bond is $886, and the current market rate for bonds with this risk level is 10%. Calculate the below yields on this bond. INPUT AREA Interest payment Par Market rate Current value Call value @ 105 Years to maturity Years to call OUTPUT AREA Coupon Current Yield to maturity Yield to call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts