Question: 1) You will create a sheet that prepares the monthly cash budget using the data below as well as the other data provided in the

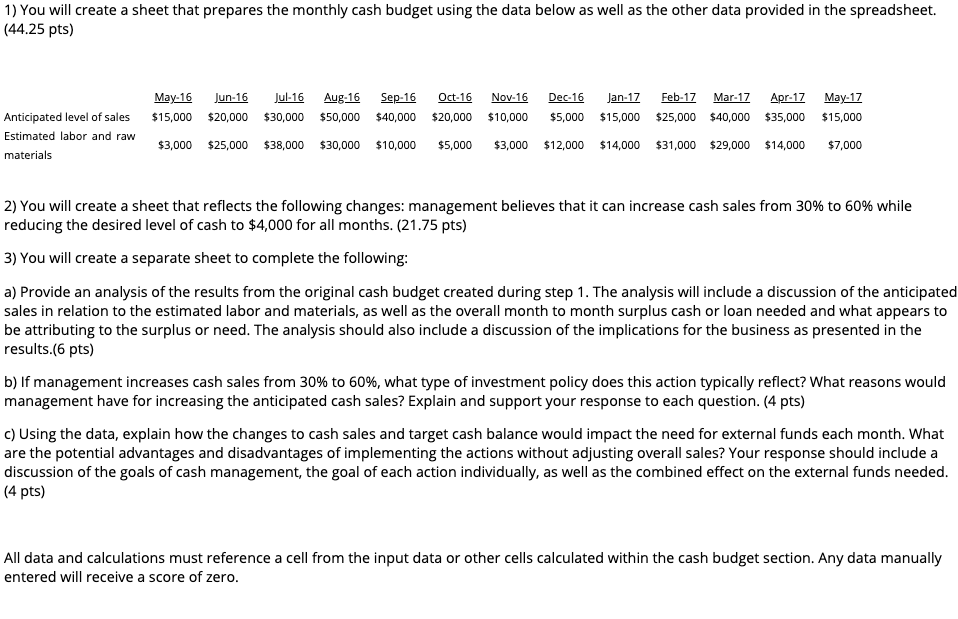

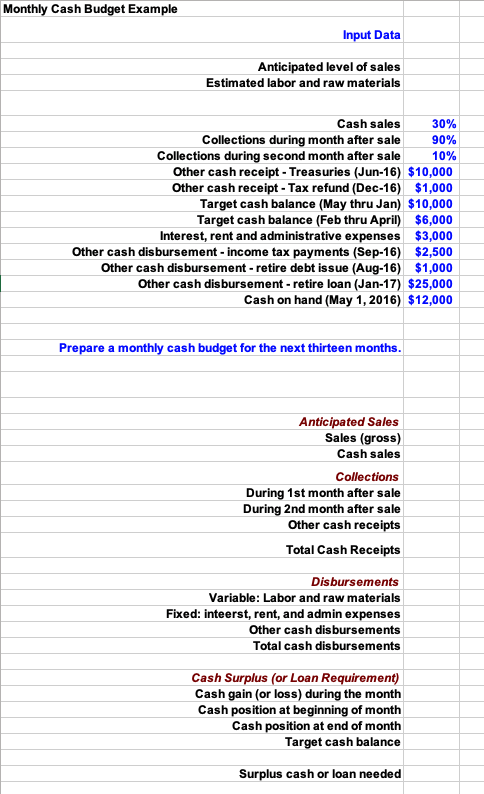

1) You will create a sheet that prepares the monthly cash budget using the data below as well as the other data provided in the spreadsheet. (44.25 pts) Jul-16 Sep-16 Nov-16 Dec-16 Feb-17 Apr-17 May-16 Jun-16 Aug-16 Oct-16 Jan-17 Mar-17 May-17 Anticipated level of sales $40,000 $15,000 $20,000 $30,000 $50,000 $40,000 $20,000 $10,000 $5,000 $15,000 $25,000 $35,000 $15,000 Estimated labor and raw $10,000 $12,000 $14,000 $7,000 $3,000 $25,000 $38,000 $30,000 $5,000 $3,000 $31,000 $29,000 $14,000 materials 2) You will create a sheet that reflects the following changes: management believes that it can increase cash sales from 30% to 60% while reducing the desired level of cash to $4,000 for all months. (21.75 pts) 3) You will create a separate sheet to complete the following: a) Provide an analysis of the results from the original cash budget created during step 1. The analysis will include a discussion of the anticipated sales in relation to the estimated labor and materials, as well as the overall month to month surplus cash or loan needed and what appears to be attributing to the surplus or need. The analysis should also include a discussion of the implications for the business as presented in the results.(6 pts) b) If management increases cash sales from 30% to 60%, what type of investment policy does this action typically reflect? What reasons would management have for increasing the anticipated cash sales? Explain and support your response to each question. (4 pts) c) Using the data, explain how the changes to cash sales and target cash balance would impact the need for external funds each month. What are the potential advantages and disadvantages of implementing the actions without adjusting overall sales? Your response should include a discussion of the goals of cash management, the goal of each action individually, as well as the combined effect on the external funds needed. (4 pts) All data and calculations must reference a cell from the input data or other cells calculated within the cash budget section. Any data manually entered will receive a s score of zero. Monthly Cash Budget Example Input Data Anticipated level of sales Estimated labor and raw materials Cash sales 30% Collections during month after sale Collections during second month after sale Other cash receipt - Treasuries (Jun-16) $10,000 Other cash receipt - Tax refund (Dec-16) $1,000 90% 10% Target cash balance (May thru Jan) $10,000 Target cash balance (Feb thru April) $6,000 Interest, rent and administrative expenses $3,000 Other cash disbursement - income tax payments (Sep-16) $2,500 Other cash disbursement -retire debt issue (Aug-16) $1,000 Other cash disbursement-retire loan (Jan-17) $25,000 Cash on hand (May 1, 2016) $12,000 Prepare a monthly cash budget for the next thirteen months Anticipated Sales Sales (gross) Cash sales Collections During 1st month after sale During 2nd month after sale Other cash receipts Total Cash Receipts Disbursements Variable: Labor and raw materials Fixed: inteerst, rent, and admin expenses Other cash disbursements Total cash disbursements Cash Surplus (or Loan Requirement) Cash gain (or loss) during the month Cash position at beginning of month Cash position at end of month Target cash balance Surplus cash or loan needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts