Question: 1. Your client invests USD8 million in a security that matures in 5 years and pays 10% annual interest rate compounded annually. Assuming interim cash

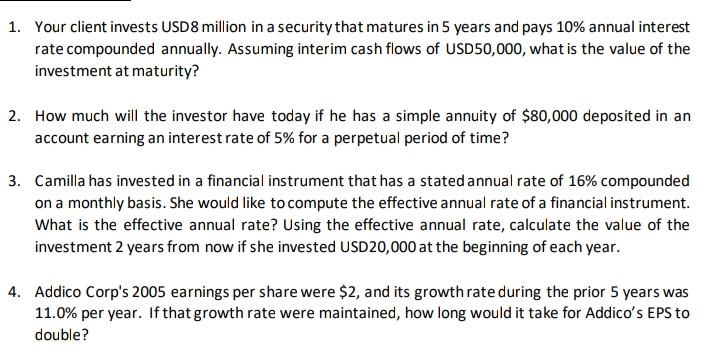

1. Your client invests USD8 million in a security that matures in 5 years and pays 10% annual interest rate compounded annually. Assuming interim cash flows of USD50,000, what is the value of the investment at maturity? 2. How much will the investor have today if he has a simple annuity of $80,000 deposited in an account earning an interest rate of 5% for a perpetual period of time? 3. Camilla has invested in a financial instrument that has a stated annual rate of 16% compounded on a monthly basis. She would like to compute the effective annual rate of a financial instrument. What is the effective annual rate? Using the effective annual rate, calculate the value of the investment 2 years from now if she invested USD20,000 at the beginning of each year. 4. Addico Corp's 2005 earnings per share were $2, and its growth rate during the prior 5 years was 11.0% per year. If that growth rate were maintained, how long would it take for Addico's EPS to double

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts