Question: 1. Your client, Robert, has started a new job and is concerned about his retirement. Robert is 44 years old. His current salary is $50,000.

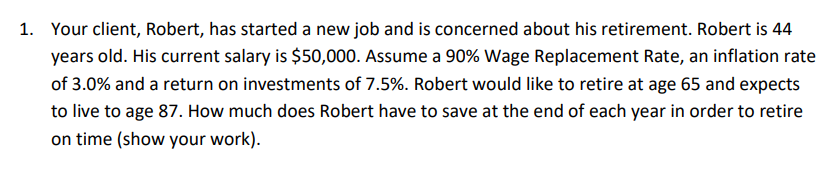

1. Your client, Robert, has started a new job and is concerned about his retirement. Robert is 44 years old. His current salary is $50,000. Assume a 90% Wage Replacement Rate, an inflation rate of 3.0% and a return on investments of 7.5%. Robert would like to retire at age 65 and expects to live to age 87. How much does Robert have to save at the end of each year in order to retire on time (show your work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts