Question: 1. Your engineering firm needs a rapid prototyping machine. The company gives you two options. In Option 1 you purchase the machine outright for $50,000,

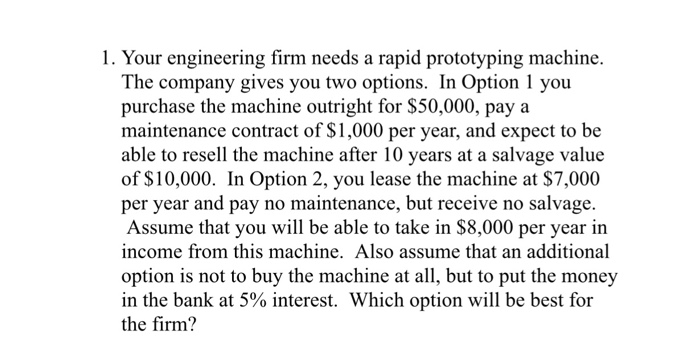

1. Your engineering firm needs a rapid prototyping machine. The company gives you two options. In Option 1 you purchase the machine outright for $50,000, pay a maintenance contract of S1,000 per year, and expect to be able to resell the machine after 10 years at a salvage value of $10,000. In Option 2, you lease the machine at $7,000 per year and pay no maintenance, but receive no salvage Assume that you will be able to take in $8,000 per year in income from this machine. Also assume that an additional option is not to buy the machine at all, but to put the money in the bank at 5% interest. Which option will be best for the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts