Question: 1) Your firm has just issued five-year floating- rate notes indexed to six-month U.S. dollar LIBOR plus 1/4%. What is the amount of the first

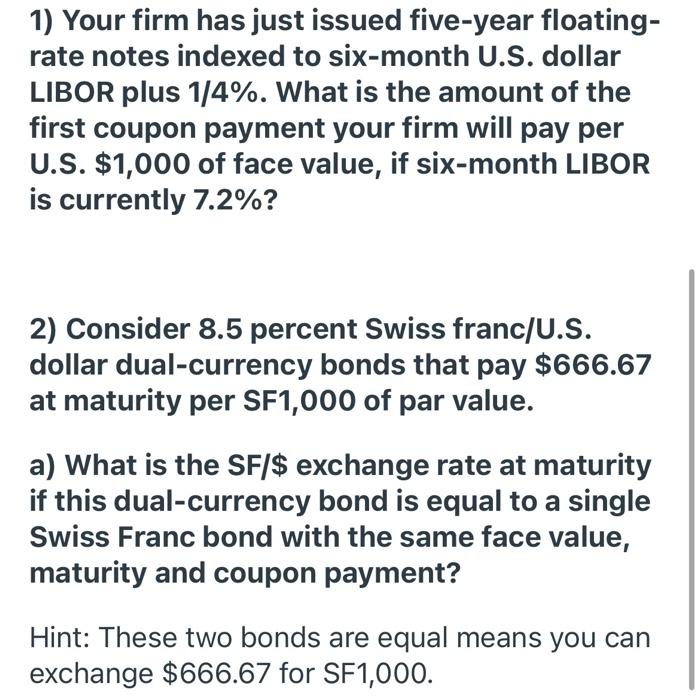

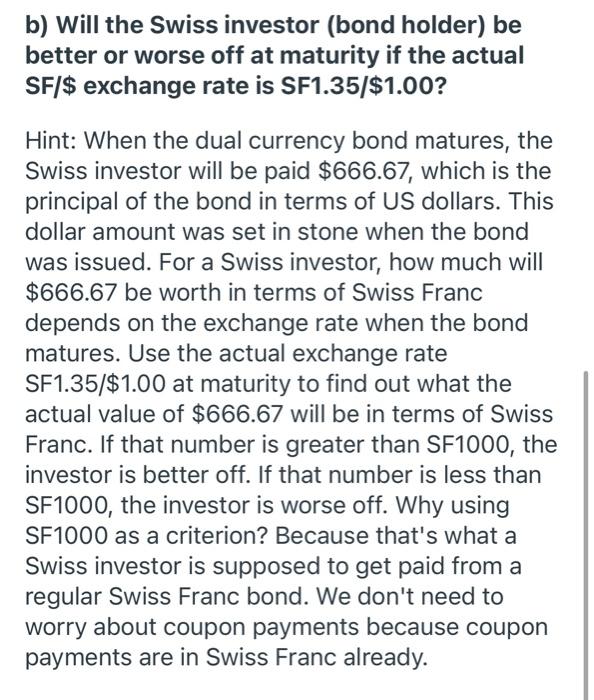

1) Your firm has just issued five-year floating- rate notes indexed to six-month U.S. dollar LIBOR plus 1/4%. What is the amount of the first coupon payment your firm will pay per U.S. $1,000 of face value, if six-month LIBOR is currently 7.2%? 2) Consider 8.5 percent Swiss franc/U.S. dollar dual-currency bonds that pay $666.67 at maturity per SF1,000 of par value. a) What is the SF/$ exchange rate at maturity if this dual-currency bond is equal to a single Swiss Franc bond with the same face value, maturity and coupon payment? Hint: These two bonds are equal means you can exchange $666.67 for SF1,000. b) Will the Swiss investor (bond holder) be better or worse off at maturity if the actual SF/$ exchange rate is SF1.35/$1.00? Hint: When the dual currency bond matures, the Swiss investor will be paid $666.67, which is the principal of the bond in terms of US dollars. This dollar amount was set in stone when the bond was issued. For a Swiss investor, how much will $666.67 be worth in terms of Swiss Franc depends on the exchange rate when the bond matures. Use the actual exchange rate SF1.35/$1.00 at maturity to find out what the actual value of $666.67 will be in terms of Swiss Franc. If that number is greater than SF1000, the investor is better off. If that number is less than SF1000, the investor is worse off. Why using SF1000 as a criterion? Because that's what a Swiss investor is supposed to get paid from a regular Swiss Franc bond. We don't need to worry about coupon payments because coupon payments are in Swiss Franc already

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts