Question: 10. 0l value: 1.00 points Exercise 11-16 Computing payroll taxes LO P2, P3 Mester Company has 10 employees. FICA Social Security taxes are 6.2% of

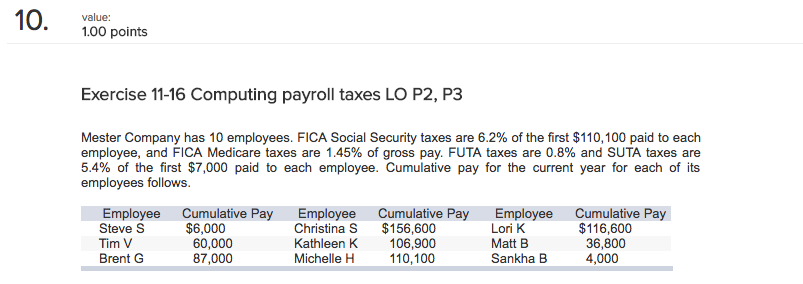

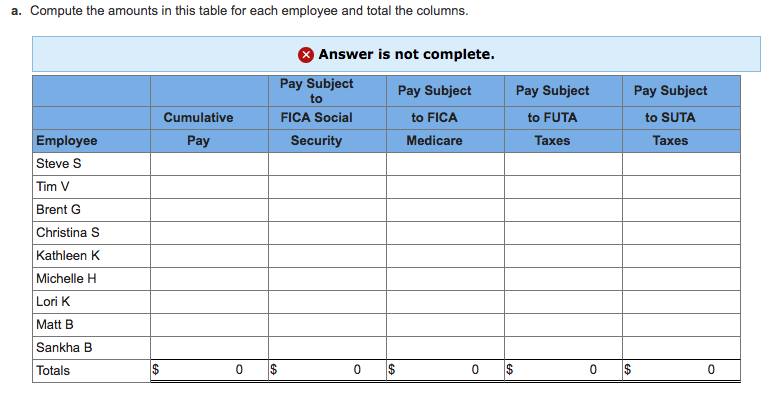

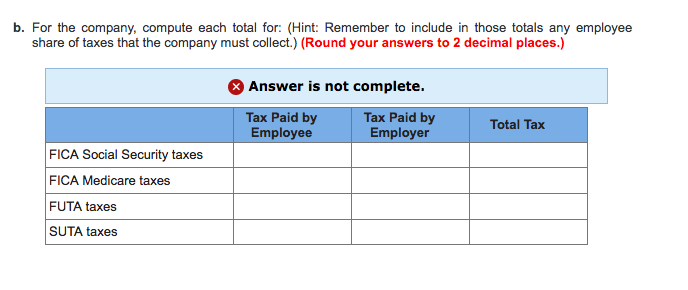

10. 0l value: 1.00 points Exercise 11-16 Computing payroll taxes LO P2, P3 Mester Company has 10 employees. FICA Social Security taxes are 6.2% of the first $110,100 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.8% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows Cumulative Pay $6,000 Employee Steve S Tim V Brent G Employee Christina S Kathleen K Michelle H Cumulative PayEmployee Cumulative Pay 60,000 87,000 $156,600 106,900 110,100 Lori K Matt B Sankha EB $116,600 36,800 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts