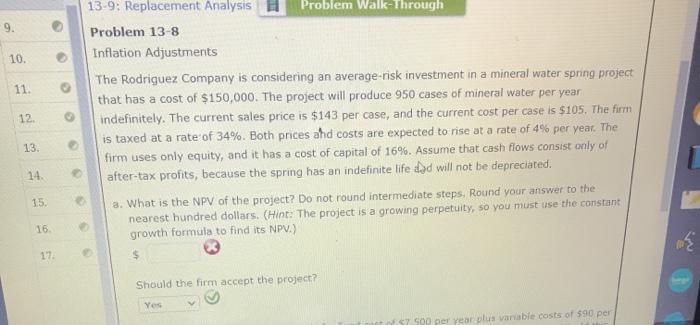

Question: 10. 11. 12 13-9: Replacement Analysis Problem Walk-Through Problem 13-8 Inflation Adjustments The Rodriguez Company is considering an average-risk investment in a mineral water spring

10. 11. 12 13-9: Replacement Analysis Problem Walk-Through Problem 13-8 Inflation Adjustments The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has a cost of $150,000. The project will produce 950 cases of mineral water per year indefinitely. The current sales price is $143 per case, and the current cost per case is $105. The firm is taxed at a rate of 34%. Both prices ahd costs are expected to rise at a rate of 4% per year. The firm uses only equity, and it has a cost of capital of 16%. Assume that cash flows consist only of after-tax profits, because the spring has an indefinite life dod will not be depreciated. a. What is the NPV of the project? Do not round intermediate steps, Round your answer to the nearest hundred dollars. (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV) 13 14 15. 16 17 $ Should the firm accept the project? Yes 52 500 per year plus variable costs of 590 per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts