Question: 10. 11. An analyst is evaluating securities in a developing nation where the inflation rate is very high. As a result, the analyst has been

10.

11.

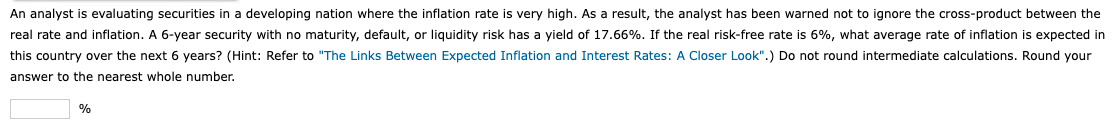

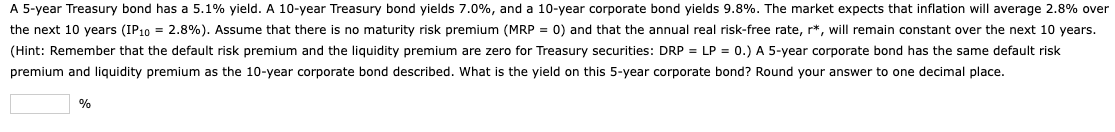

An analyst is evaluating securities in a developing nation where the inflation rate is very high. As a result, the analyst has been warned not to ignore the cross-product between the real rate and inflation. A 6-year security with no maturity, default, or liquidity risk has a yield of 17.66%. If the real risk-free rate is 6%, what average rate of inflation is expected in this country over the next 6 years? (Hint: Refer to "The Links Between Expected Inflation and Interest Rates: A Closer Look".) Do not round intermediate calculations. Round your answer to the nearest whole number. % A 5-year Treasury bond has a 5.1% yield. A 10-year Treasury bond yields 7.0%, and a 10-year corporate bond yields 9.8%. The market expects that inflation will average 2.8% over the next 10 years (IP 10 = 2.8%). Assume that there is no maturity risk premium (MRP = 0) and that the annual real risk-free rate, r*, will remain constant over the next 10 years. (Hint: Remember that the default risk premium and the liquidity premium are zero for Treasury securities: DRP = LP = 0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. What is the yield on this 5-year corporate bond? Round your answer to one decimal place. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts