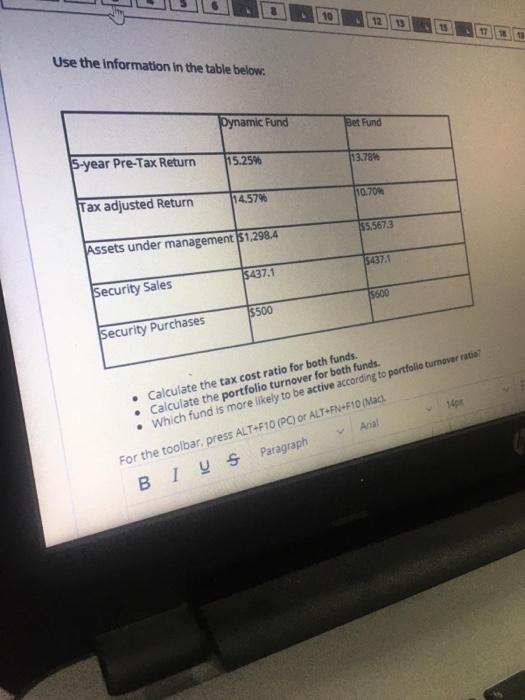

Question: 10 12 Use the information in the table below. Pynamic Fund Bet Fund 115.25% 13.784 5-year Pre-Tax Return 10.700 14,5796 Tax adjusted Return 55,5673 Assets

10 12 Use the information in the table below. Pynamic Fund Bet Fund 115.25% 13.784 5-year Pre-Tax Return 10.700 14,5796 Tax adjusted Return 55,5673 Assets under management 51,298.4 15437.1 5437.1 Security Sales 5600 5500 Security Purchases Calculate the tax cost ratio for both funds. Calculate the portfolio turnover for both funds. Which fund is more likely to be active according to portfolio turnover rate? For the toolbar, press ALT+F10 (PO) or ALT+FN+F10(Mac ys Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts