Question: 10. a. Compute Aces WACCs based on the companys target capital structure and construct the marginal cost of capital (MCC) schedule. How large could the

b. Would the MCC schedule remain constant beyond the retained earnings break point, no matter how much new capital it raised? Explain. Again, ignore depreciation.

c. How does depreciation affect the MCC schedule? If depreciation were simply ignored, would this affect the acceptability of proposed capital projects? Explain.

11. Should the corporate cost of capital as developed above be used for all projects? If not, what type of adjustments should be made?

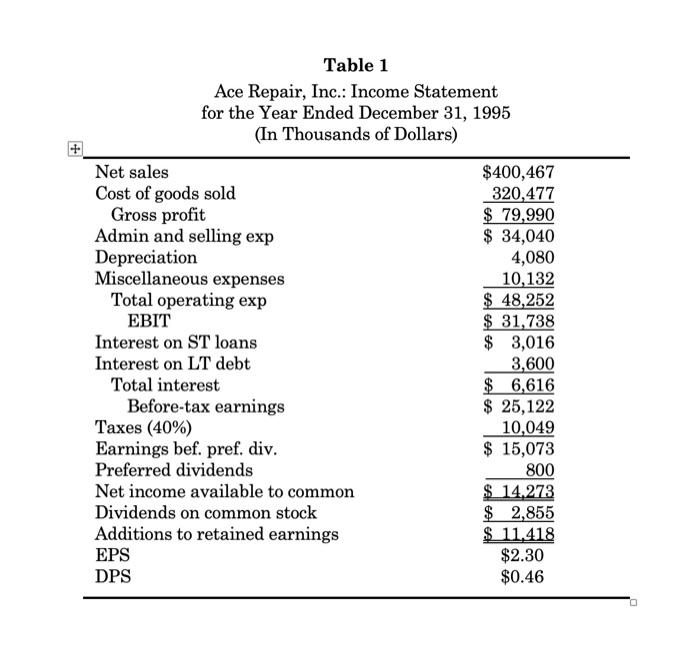

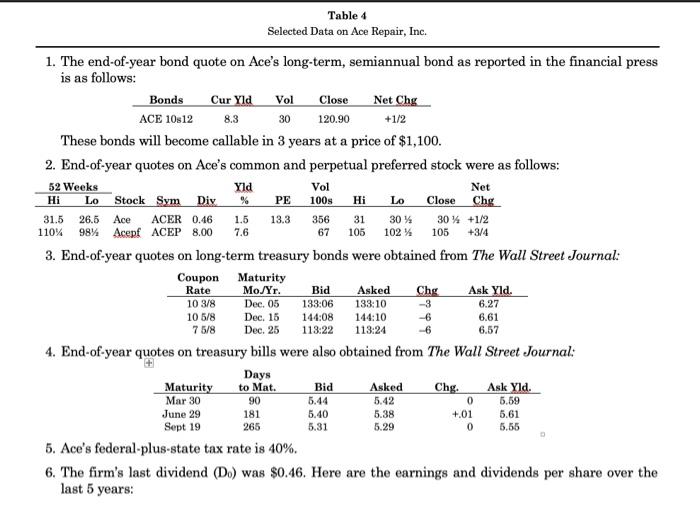

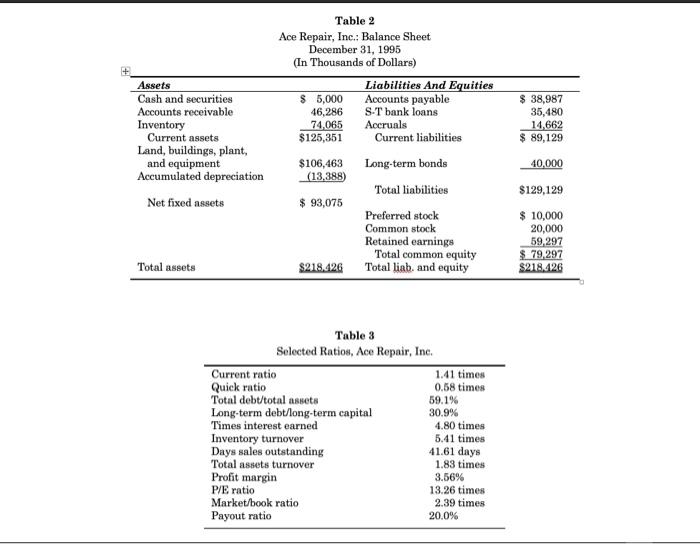

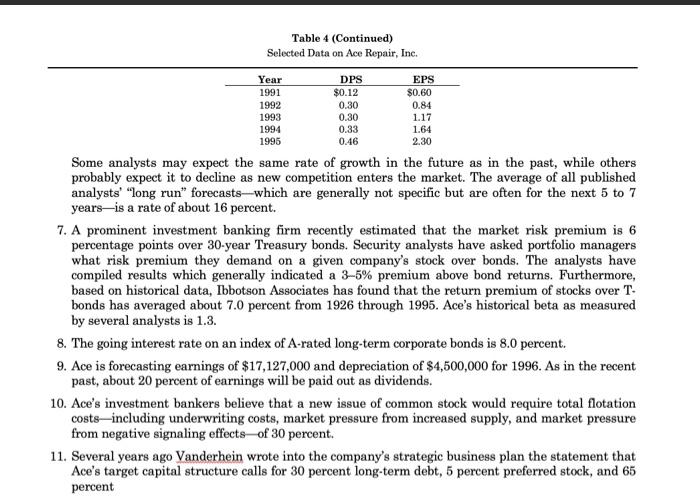

Table 1 Ace Repair, Inc.: Income Statement for the Year Ended December 31, 1995 Table 4 Selected Data on Ace Repair, Inc. 1. The end-of-year bond quote on Ace's long-term, semiannual bond as reported in the financial press is as follows: These bonds will become callable in 3 years at a price of $1,100. 2. End-of-year quotes on Ace's common and perpetual preferred stock were as follows: 3. End-of-year quotes on long-term treasury bonds were obtained from The Wall Street Journal: 4. End-of-year quotes on treasury bills were also obtained from The Wall Street Journal: 5. Ace's federal-plus-state tax rate is 40%. 6. The firm's last dividend (D0) was $0.46. Here are the earnings and dividends per share over the last 5 years: Table 2 Ace Repair, Inc.; Balance Sheet December 31, 1995 (In Thousands of Dollars) Table 3 Selected Ratios, Ace Repair, Inc. Table 4 (Continued) Selected Data on Ace Repair, Ine. Some analysts may expect the same rate of growth in the future as in the past, while others probably expect it to decline as new competition enters the market. The average of all published analysts' "long run" forecasts - which are generally not specific but are often for the next 5 to 7 years - is a rate of about 16 percent. 7. A prominent investment banking firm recently estimated that the market risk premium is 6 percentage points over 30-year Treasury bonds. Security analysts have asked portfolio managers what risk premium they demand on a given company's stock over bonds. The analysts have compiled results which generally indicated a 35% premium above bond returns. Furthermore, based on historical data, Ibbotson Associates has found that the return premium of stocks over Tbonds has averaged about 7.0 percent from 1926 through 1995. Ace's historical beta as measured by several analysts is 1.3. 8. The going interest rate on an index of A-rated long-term corporate bonds is 8.0 percent. 9. Ace is forecasting earnings of $17,127,000 and depreciation of $4,500,000 for 1996 . As in the recent past, about 20 percent of earnings will be paid out as dividends. 10. Ace's investment bankers believe that a new issue of common stock would require total flotation costs-including underwriting costs, market pressure from increased supply, and market pressure from negative signaling effects - of 30 percent. 11. Several years ago Vanderhein wrote into the company's strategic business plan the statement that Ace's target capital structure calls for 30 percent long-term debt, 5 percent preferred stock, and 65 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts