Question: 1.0. ACCOUNTING IMPLICATIONS (Contd) 1. Develop pro forma (budget) financial statements (including income statement, Introduction balance sheet, and statement of cash flows. 2. Develop cash

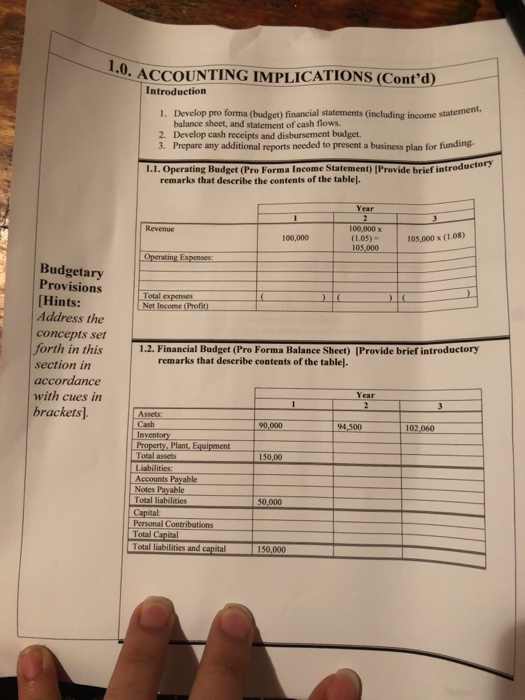

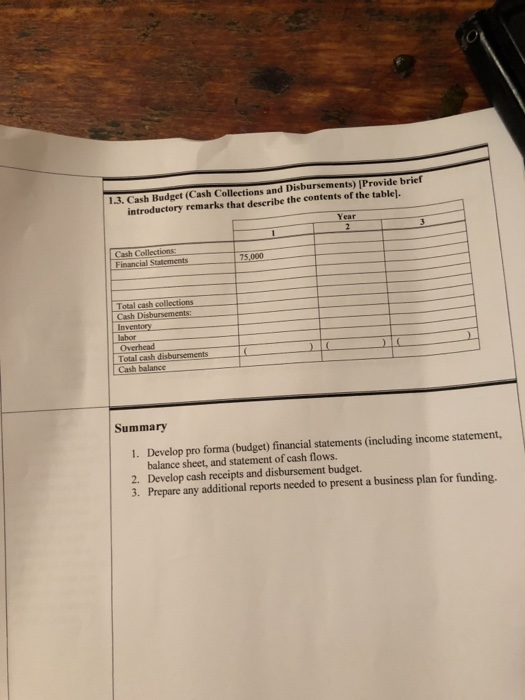

1.0. ACCOUNTING IMPLICATIONS (Contd) 1. Develop pro forma (budget) financial statements (including income statement, Introduction balance sheet, and statement of cash flows. 2. Develop cash receipts and disbursement budget. 3. Prepare any additional reports needed to present a business plan for funding. 1.1. Operating Budget (Pro Forma Income Statement) [Provide brief introductory remarks that describe the contents of the table). 1 Revenue Year 2 100,000 x (105) 105,000 100,000 105.000 (1.08) Operating Expenses Total expenses Net Income (Profit) Budgetary Provisions [Hints: Address the concepts ser forth in this section in accordance with cues in brackets) 1.2. Financial Budget (Pro Forma Balance Sheet) [Provide brief introductory remarks that describe contents of the table). Year 2 1 90,000 94,500 102,060 150,00 Assets: Cash Inventory Property, Plant, Equipment Total assets Liabilities: Accounts Payable Notes Payable Total liabilities Capital: Personal Contributions Total Capital Total liabilities and capital 50.000 150,000 1.3. Cash Budget (Cash Collections and Disbursements) [Provide brief introductory remarks that describe the contents of the table. Year 2 1 Cash Collections Financial Statements 75.000 Total cash collections Cash Disbursements: Inventory labor Overhead Total cash disbursements Cash balance Summary 1. Develop pro forma (budget) financial statements (including income statement, balance sheet, and statement of cash flows. 2. Develop cash receipts and disbursement budget. 3. Prepare any additional reports needed to present a business plan for funding. 1.0. ACCOUNTING IMPLICATIONS (Contd) 1. Develop pro forma (budget) financial statements (including income statement, Introduction balance sheet, and statement of cash flows. 2. Develop cash receipts and disbursement budget. 3. Prepare any additional reports needed to present a business plan for funding. 1.1. Operating Budget (Pro Forma Income Statement) [Provide brief introductory remarks that describe the contents of the table). 1 Revenue Year 2 100,000 x (105) 105,000 100,000 105.000 (1.08) Operating Expenses Total expenses Net Income (Profit) Budgetary Provisions [Hints: Address the concepts ser forth in this section in accordance with cues in brackets) 1.2. Financial Budget (Pro Forma Balance Sheet) [Provide brief introductory remarks that describe contents of the table). Year 2 1 90,000 94,500 102,060 150,00 Assets: Cash Inventory Property, Plant, Equipment Total assets Liabilities: Accounts Payable Notes Payable Total liabilities Capital: Personal Contributions Total Capital Total liabilities and capital 50.000 150,000 1.3. Cash Budget (Cash Collections and Disbursements) [Provide brief introductory remarks that describe the contents of the table. Year 2 1 Cash Collections Financial Statements 75.000 Total cash collections Cash Disbursements: Inventory labor Overhead Total cash disbursements Cash balance Summary 1. Develop pro forma (budget) financial statements (including income statement, balance sheet, and statement of cash flows. 2. Develop cash receipts and disbursement budget. 3. Prepare any additional reports needed to present a business plan for funding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts