Question: 10. answer a b c and d 11 12 Zero-coupon bond. Addison Company will issue a zero-coupon bond this coming month. The bond's projected yield

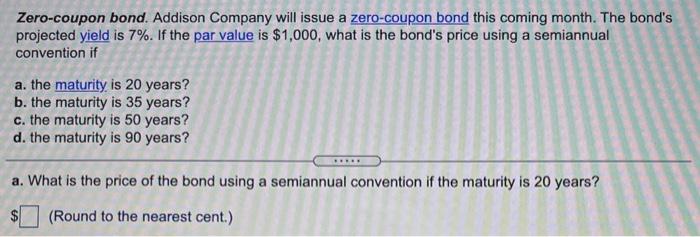

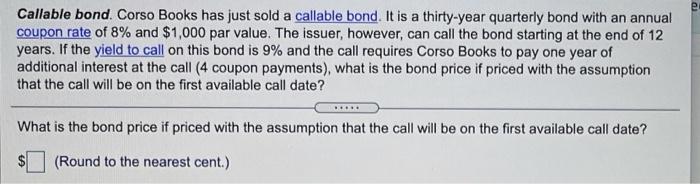

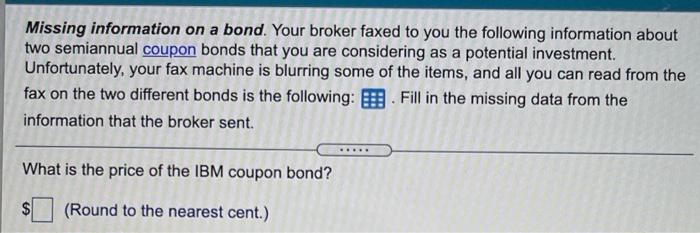

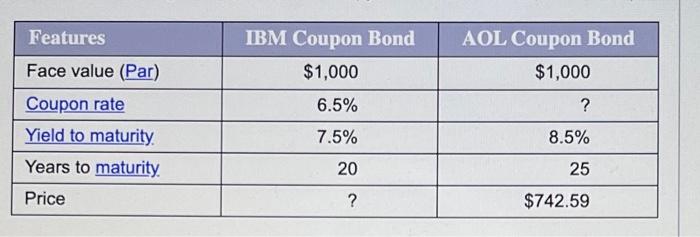

Zero-coupon bond. Addison Company will issue a zero-coupon bond this coming month. The bond's projected yield is 7%. If the par value is $1,000, what is the bond's price using a semiannual convention if a. the maturity is 20 years? b. the maturity is 35 years? c. the maturity is 50 years? d. the maturity is 90 years? a. What is the price of the bond using a semiannual convention if the maturity is 20 years? (Round to the nearest cent.) Callable bond. Corso Books has just sold a callable bond. It is a thirty-year quarterly bond with an annual coupon rate of 8% and $1,000 par value. The issuer, however, can call the bond starting at the end of 12 years. If the yield to call on this bond is 9% and the call requires Corso Books to pay one year of additional interest at the call (4 coupon payments), what is the bond price if priced with the assumption that the call will be on the first available call date? . What is the bond price if priced with the assumption that the call will be on the first available call date? (Round to the nearest cent.) Missing information on a bond. Your broker faxed to you the following information about two semiannual coupon bonds that you are considering as a potential investment. Unfortunately, your fax machine is blurring some of the items, and all you can read from the fax on the two different bonds is the following: D. Fill in the missing data from the information that the broker sent. What is the price of the IBM coupon bond? (Round to the nearest cent.) IBM Coupon Bond $1,000 AOL Coupon Bond $1,000 6.5% ? Features Face value (Par) Coupon rate Yield to maturity Years to maturity Price 7.5% 8.5% 20 25 ? $742.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts