Question: 10 Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value in 15 years.

10

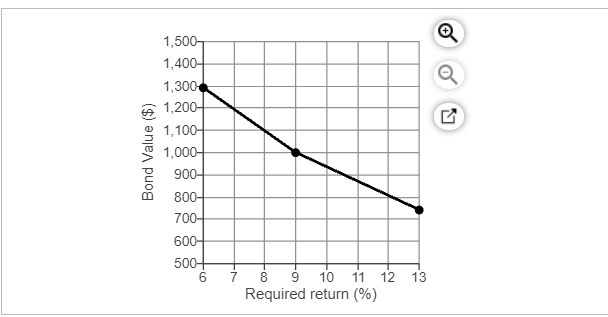

Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value in 15 years. The bond has a coupon interest rate of 9% and pays interest annually. a. Find the bond value if the required return is (1) 9%, (2) 13%, and (3) 6%. b. Use your finding in part a and the graph here, w, to discuss the relationship between the coupon rate, the required return and the market value of the bond relative to its par value. c. What two possible reasons could cause the required return to differ from the coupon interest rate? .. a. (1) The value of the bond, if the required return is 9%, is $ (Round to the nearest cent.) 1,500 1,400 1,300 1,200- 1,100 1,000 900- 800- 7 Bond Value ($) 700- 600 500+ 6 7 8 9 10 11 12 13 Required return (%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts