Question: 10. Comparing payments on installment loans when using the simple-interest or add-on Aa Aa methods to compute finance charges Comparing Loan Payments Using the Simple-Interest

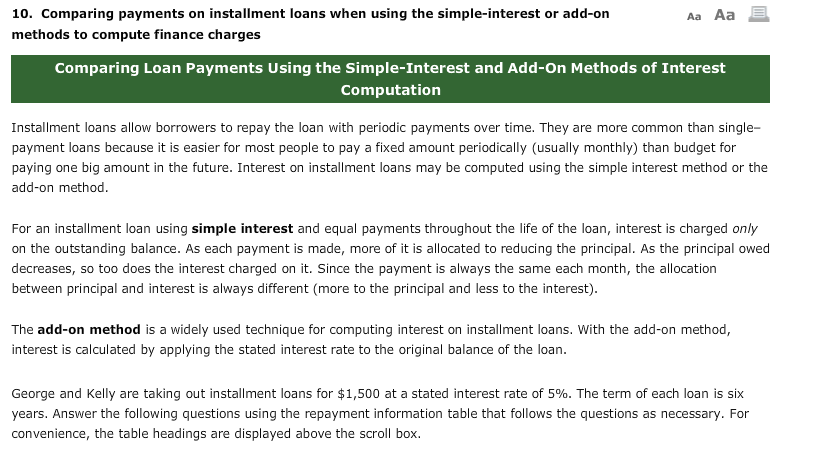

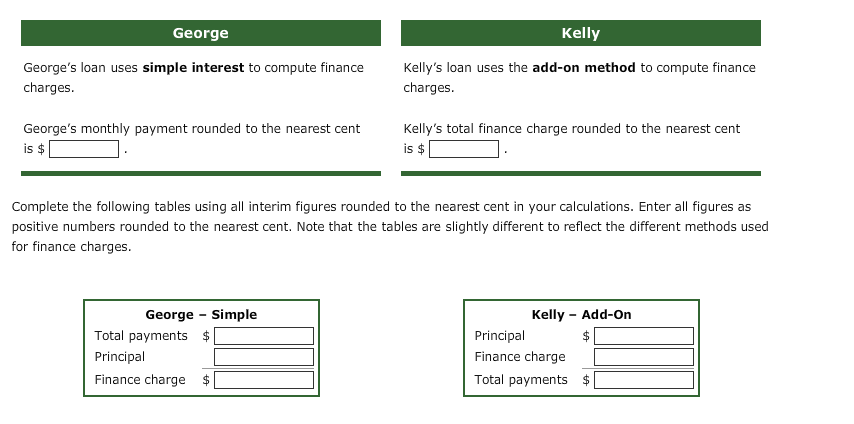

10. Comparing payments on installment loans when using the simple-interest or add-on Aa Aa methods to compute finance charges Comparing Loan Payments Using the Simple-Interest and Add-On Methods of Interest Computation Installment loans allow borrowers to repay the loan with periodic payments over time. They are more common than single- payment loans because it is easier for most people to pay a fixed amount periodically (usually monthly) than budget for paying one big amount in the future. Interest on installment loans may be computed using the simple interest method or the add-on method. For an installment loan using simple interest and equal payments throughout the life of the loan, interest is charged only on the outstanding balance. As each payment is made, more of it is allocated to reducing the principal. As the principal owed decreases, so too does the interest charged on it. Since the payment is always the same each month, the allocation between principal and interest is always different (more to the principal and less to the interest) The add-on method is a widely used technique for computing interest installment loans. With the add-on method, on interest is calculated by applying the stated interest rate to the original balance of the loan. George and Kelly are taking out installment loans for $1,5000 at a stated interest rate of 5%. The term of each loan is six years. Answer the following questions using the repayment information table that follows the questions as necessary. For displayed above the scroll box convenience, the table headings are Kelly George George's loan uses simple interest to compute finance Kelly's loan uses the add-on method to compute finance charges charges Kelly's total finance charge rounded to the nearest cent George's monthly payment rounded to the nearest cent is $ is $ Complete the following tables using all interim figures rounded to the nearest cent in your calculations. Enter all figures as positive numbers rounded to the nearest cent. Note that the tables are slightly different to reflect the different methods used for finance charges. Kelly Add-On George Simple Total payments $ Principal $ Finance charge Principal Finance charge $ Total payments $ 10. Comparing payments on installment loans when using the simple-interest or add-on Aa Aa methods to compute finance charges Comparing Loan Payments Using the Simple-Interest and Add-On Methods of Interest Computation Installment loans allow borrowers to repay the loan with periodic payments over time. They are more common than single- payment loans because it is easier for most people to pay a fixed amount periodically (usually monthly) than budget for paying one big amount in the future. Interest on installment loans may be computed using the simple interest method or the add-on method. For an installment loan using simple interest and equal payments throughout the life of the loan, interest is charged only on the outstanding balance. As each payment is made, more of it is allocated to reducing the principal. As the principal owed decreases, so too does the interest charged on it. Since the payment is always the same each month, the allocation between principal and interest is always different (more to the principal and less to the interest) The add-on method is a widely used technique for computing interest installment loans. With the add-on method, on interest is calculated by applying the stated interest rate to the original balance of the loan. George and Kelly are taking out installment loans for $1,5000 at a stated interest rate of 5%. The term of each loan is six years. Answer the following questions using the repayment information table that follows the questions as necessary. For displayed above the scroll box convenience, the table headings are Kelly George George's loan uses simple interest to compute finance Kelly's loan uses the add-on method to compute finance charges charges Kelly's total finance charge rounded to the nearest cent George's monthly payment rounded to the nearest cent is $ is $ Complete the following tables using all interim figures rounded to the nearest cent in your calculations. Enter all figures as positive numbers rounded to the nearest cent. Note that the tables are slightly different to reflect the different methods used for finance charges. Kelly Add-On George Simple Total payments $ Principal $ Finance charge Principal Finance charge $ Total payments $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts