Question: 10. Computing the federal transfer tax Practice 2 Aa Aa E Adam Schallock died in 2012, leaving an estate of $24,000,000. Adam's wife died in

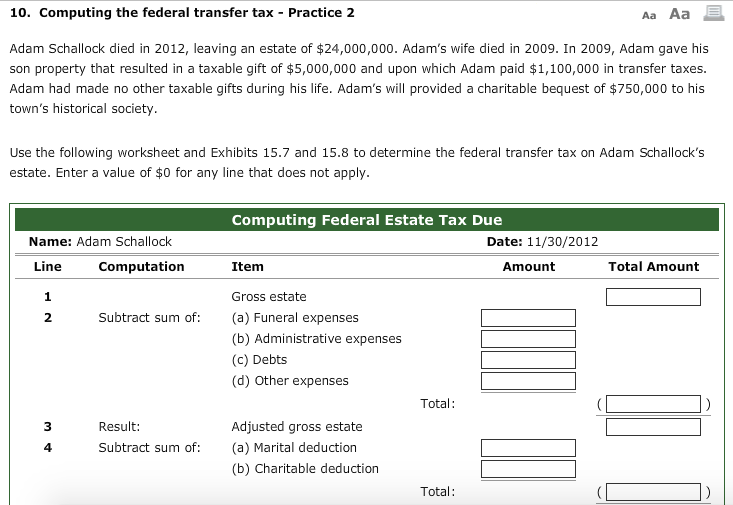

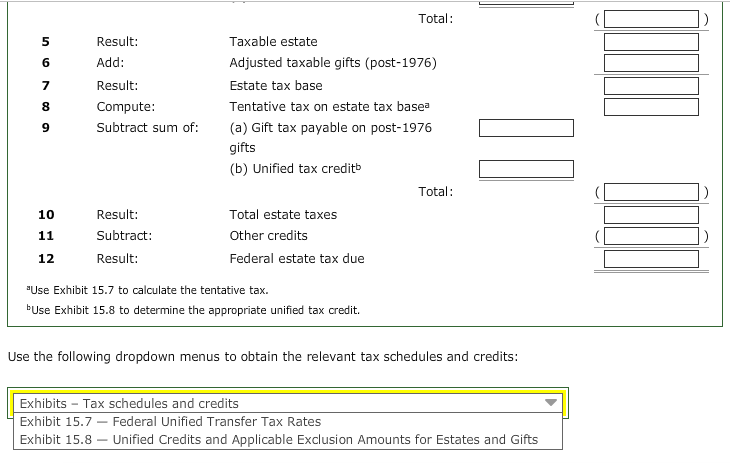

10. Computing the federal transfer tax Practice 2 Aa Aa E Adam Schallock died in 2012, leaving an estate of $24,000,000. Adam's wife died in 2009. In 2009, Adam gave his son property that resulted in a taxable gift of $5,000,000 and upon which Adam paid $1,100,000 in transfer taxes. Adam had made no other taxable gifts during his life. Adam's will provided a charitable bequest of $750,000 to his town's historical society. Use the following worksheet and Exhibits 15.7 and 15.8 to determine the federal transfer tax on Adam Schallock's estate. Enter a value of $0 for any line that does not apply. Computing Federal Estate Tax Due Name Adam Schallock Date: 11/30/2012 Line Computation Total Amount Item Amount Gross estate Subtract sum of (a) Funeral expenses (b) Administrative expenses (c) Debts (d) other expenses Total: Result: Adjusted gross estate Subtract sum ol (a) Marital deduction (b) Charitable deduction Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts