Question: 10. Consider a $1000 face value risk-free 1-year zero coupon with an interest rate of 5%. Consider a 1-year zero-coupon bond with the following risky

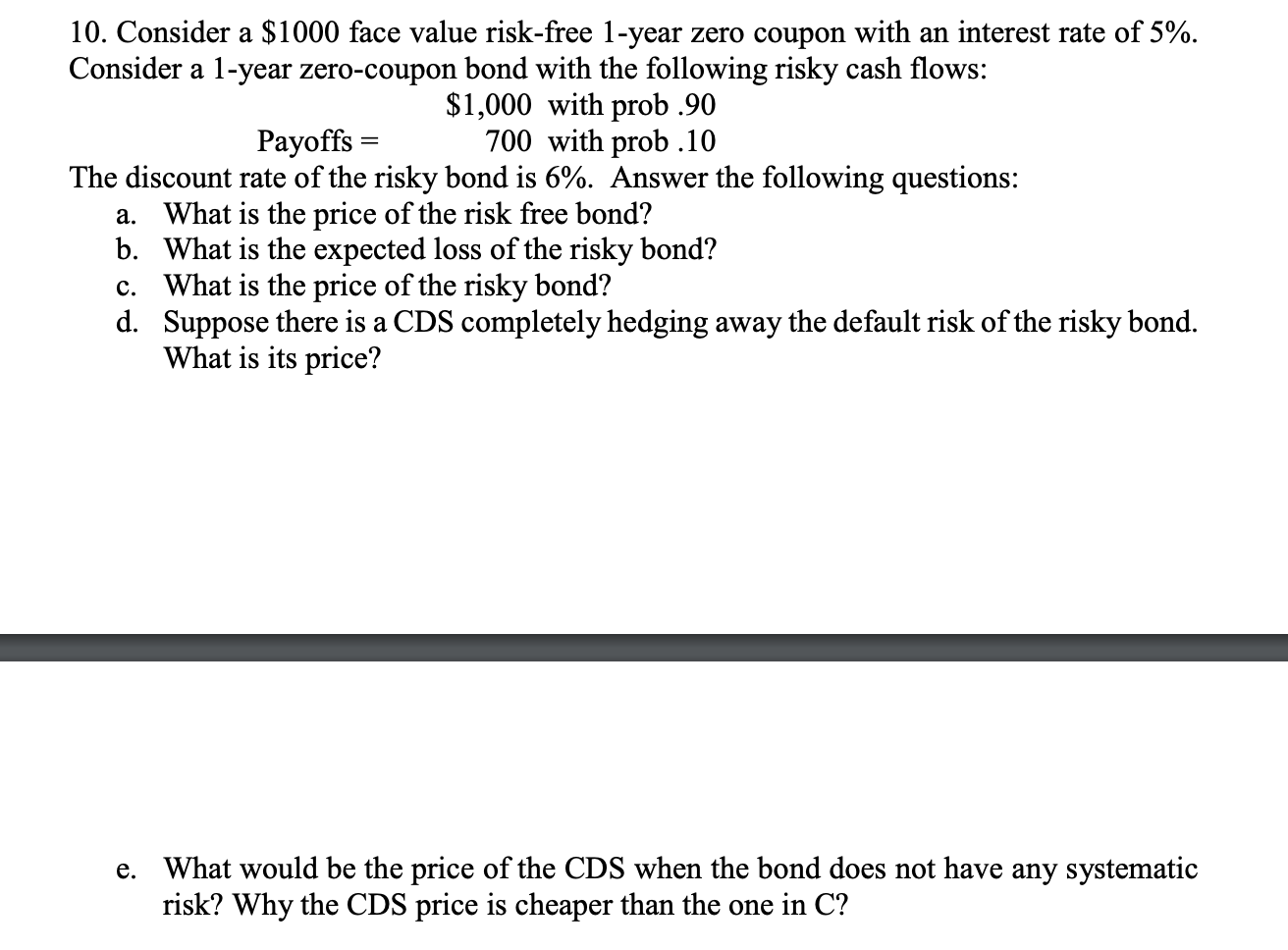

10. Consider a $1000 face value risk-free 1-year zero coupon with an interest rate of 5%. Consider a 1-year zero-coupon bond with the following risky cash flows: $1,000 with prob .90 Payoffs = 700 with prob .10 The discount rate of the risky bond is 6%. Answer the following questions: a. What is the price of the risk free bond? b. What is the expected loss of the risky bond? c. What is the price of the risky bond? d. Suppose there is a CDS completely hedging away the default risk of the risky bond. What is its price? e. What would be the price of the CDS when the bond does not have any systematic risk? Why the CDS price is cheaper than the one in C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts