Question: 10) Consider that you are paying back a fully amortized loan. Which of the following statements is most correct? A) Later loan payments involve larger

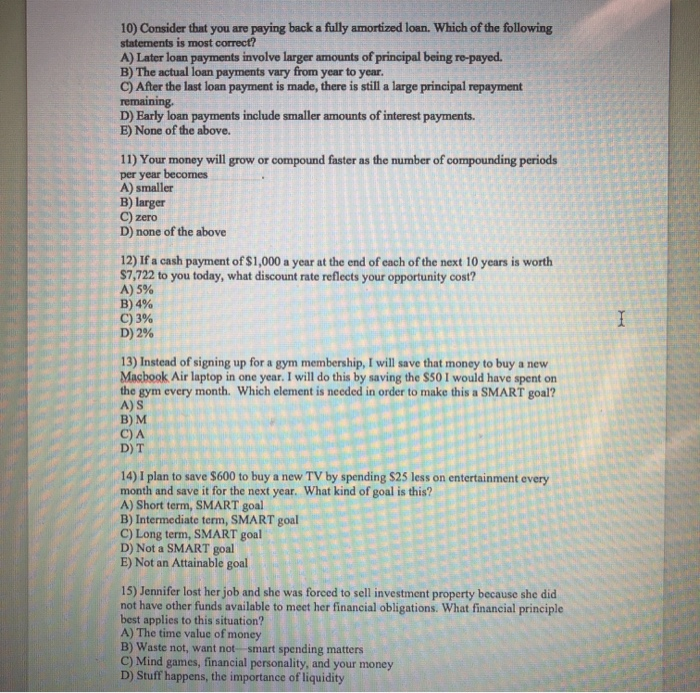

10) Consider that you are paying back a fully amortized loan. Which of the following statements is most correct? A) Later loan payments involve larger amounts of principal being re-payed B) The actual loan payments vary from year to year C) After the last loan payment is made, there is still a large principal repayment remaining. D) Early loan payments include smaller amounts of interest payments. B) None of the above. 11) Your money will grow or compound faster as the number of compounding periods per year becomes A) smaller B) larger C) zero D) none of the above 12) If a cash payment of $1,000 a year at the end of each of the next 10 years is worth S7,722 to you today, what discount rate reflects your opportunity cost? A) 5% B) 4% C) 3% D) 2% 13) Instead of signing up for a gym membership, I will save that money to buy a new Macbook Air laptop in one year. I will do this by saving the $50 I would have spent on the gym every month. Which element is needed in order to make this a SMART goal? A) S B) M C) A D)T 14) I plan to save $600 to buy a new TV by spending $25 less on entertainment every month and save it for the next year. What kind of goal is this? A) Short term, SMART goal B) Intermediate term, SMART goal C) Long term, SMART goal D) Not a SMART goal E) Not an Attainable goal 15) Jennifer lost her job and she was forced to sell investment property because she did not have other funds available to meet her financial obligations. What financial principle best applies to this situation? A) The time value of money B) Waste not, want not smart spending matters C) Mind games, financial personality, and your money D) Stuff happens, the importance of liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts