Question: 10) Consider the formulas that we used in Chapter 13 to set u and d as a function of stock return volatility. Analyst A uses

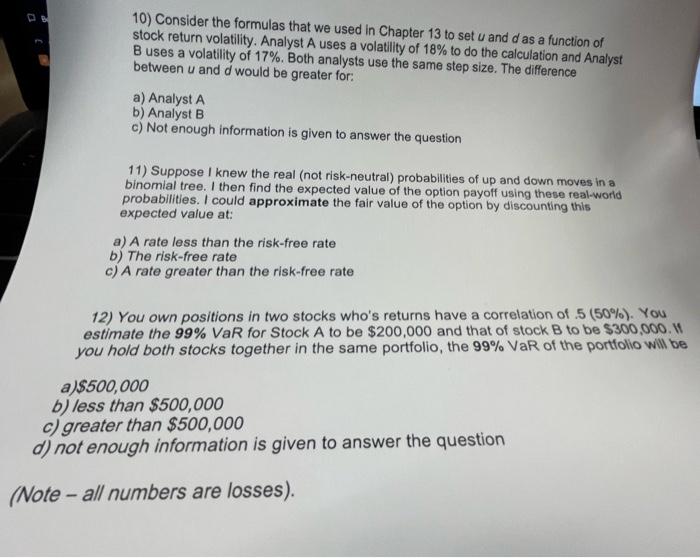

10) Consider the formulas that we used in Chapter 13 to set u and d as a function of stock return volatility. Analyst A uses a volatility of 18% to do the calculation and Analyst B uses a volatility of 17%. Both analysts use the same step size. The difference between u and d would be greater for: a) Analyst A b) Analyst B c) Not enough information is given to answer the question 11) Suppose I knew the real (not risk-neutral) probabilities of up and down moves in a binomial tree. I then find the expected value of the option payoff using these real-world probabilities. I could approximate the fair value of the option by discounting this expected value at: a) A rate less than the risk-free rate b) The risk-free rate c) A rate greater than the risk-free rate 12) You own positions in two stocks who's returns have a correlation of .5(50%). You estimate the 99% VaR for Stock A to be $200,000 and that of stock B to be $300,000. II you hold both stocks together in the same portfolio, the 99% VaR of the portfolio will be a) $500,000 b) less than $500,000 c) greater than $500,000 not enough information is given to answer the question (e - all numbers are losses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts