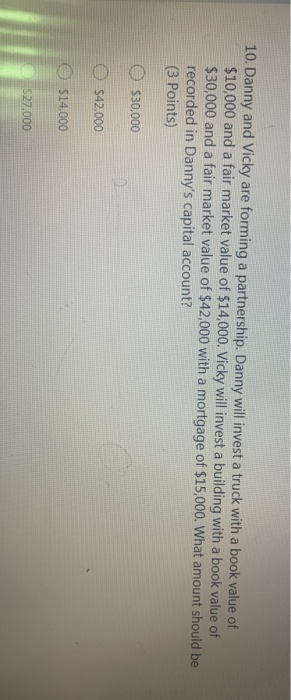

Question: 10. Danny and Vicky are forming a partnership. Danny will invest a truck with a book value of $10,000 and a fair market value of

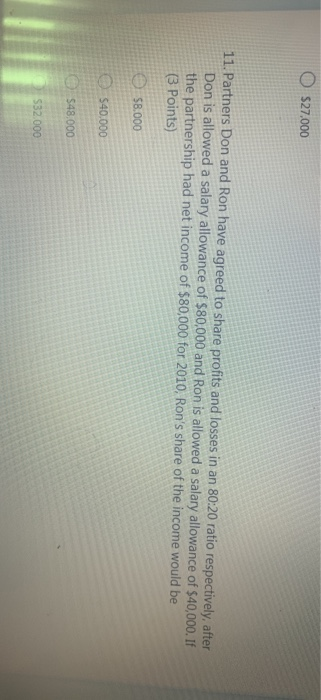

10. Danny and Vicky are forming a partnership. Danny will invest a truck with a book value of $10,000 and a fair market value of $14,000. Vicky will invest a building with a book value of $30,000 and a fair market value of $42,000 with a mortgage of $15,000. What amount should be recorded in Danny's capital account? (3 Points) $30,000 542.000 $14,000 $27,000 O $27.000 11. Partners Don and Ron have agreed to share profits and losses in an 80:20 ratio respectively, after Don is allowed a salary allowance of $80,000 and Ron is allowed a salary allowance of $40,000. If the partnership had net income of $80,000 for 2010, Ron's share of the income would be (3 Points) 58.000 540.000 $48.000 $32.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts