Question: 10) Devo Co, has an indefinite-life intangible asset with a carrying value of $782,000. The undiscounted cash flows expected to be realized from that asset

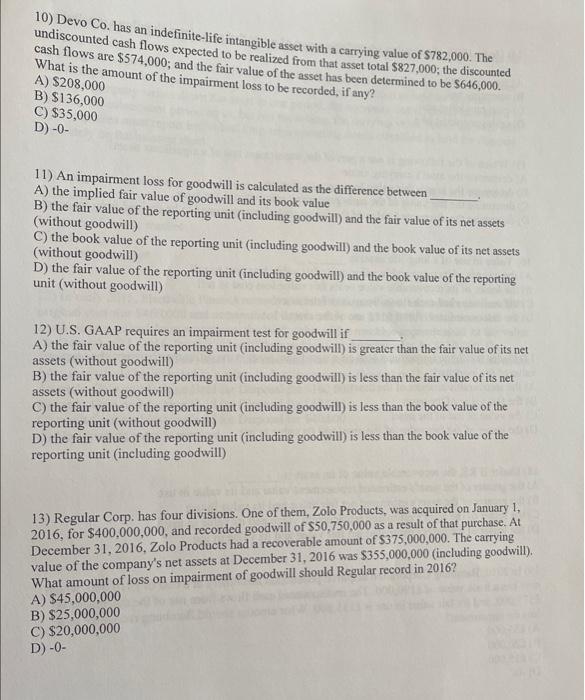

10) Devo Co, has an indefinite-life intangible asset with a carrying value of $782,000. The undiscounted cash flows expected to be realized from that asset total $827,000; the discounted A) $208,000 (he impairment loss to be recorded, if any? B) $136,000 C) $35,000 D) 0 - 11) An impairment loss for goodwill is calculated as the difference between A) the implied fair value of goodwill and its book value B) the fair value of the reporting unit (including goodwill) and the fair value of its net assets (without goodwill) C) the book value of the reporting unit (including goodwill) and the book value of its net assets (without goodwill) D) the fair value of the reporting unit (including goodwill) and the book value of the reporting unit (without goodwill) 12) U.S. GAAP requires an impairment test for goodwill if A) the fair value of the reporting unit (including goodwill) is greater than the fair value of its net assets (without goodwill) B) the fair value of the reporting unit (including goodwill) is less than the fair value of its net assets (without goodwill) C) the fair value of the reporting unit (including goodwill) is less than the book value of the reporting unit (without goodwill) D) the fair value of the reporting unit (including goodwili) is less than the book value of the reporting unit (including goodwill) 13) Regular Corp. has four divisions. One of them, Zolo Products, was acquired on January 1, 2016 , for $400,000,000, and recorded goodwill of $50,750,000 as a result of that purehase. At December 31,2016 , Zolo Products had a recoverable amount of $375,000,000. The carrying value of the company's net assets at December 31,2016 was $355,000,000 (including goodwill). What amount of loss on impairment of goodwill should Regular record in 2016 ? A) $45,000,000 B) $25,000,000 C) $20,000,000 D) 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts