Question: - 10, et+1 = = = 2. (25 points) Consider a two-period economy in which an agent consumes both in t and in t +

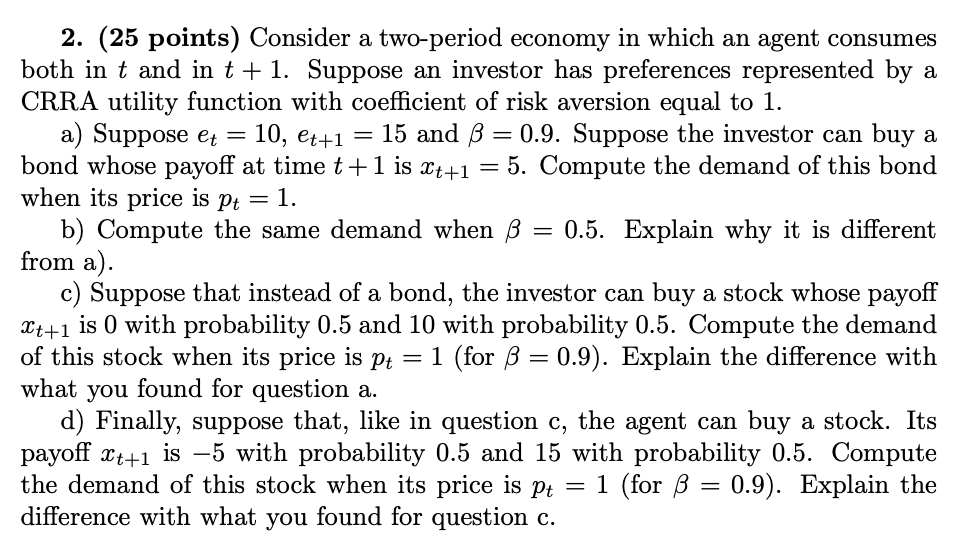

- 10, et+1 = = = 2. (25 points) Consider a two-period economy in which an agent consumes both in t and in t + 1. Suppose an investor has preferences represented by a CRRA utility function with coefficient of risk aversion equal to 1. a) Suppose et = 15 and B = 0.9. Suppose the investor can buy a bond whose payoff at time t+1 is Xt+1 = 5. Compute the demand of this bond when its price is pt = 1. b) Compute the same demand when = 0.5. Explain why it is different from a). c) Suppose that instead of a bond, the investor can buy a stock whose payoff Xt+1 is 0 with probability 0.5 and 10 with probability 0.5. Compute the demand of this stock when its price is pt = 1 (for B = 0.9). Explain the difference with ) what you found for question a. d) Finally, suppose that, like in question c, the agent can buy a stock. Its payoff 2t+1 is 5 with probability 0.5 and 15 with probability 0.5. Compute the demand of this stock when its price is pt 1 (for B = 0.9). Explain the difference with what you found for question c. = = - 10, et+1 = = = 2. (25 points) Consider a two-period economy in which an agent consumes both in t and in t + 1. Suppose an investor has preferences represented by a CRRA utility function with coefficient of risk aversion equal to 1. a) Suppose et = 15 and B = 0.9. Suppose the investor can buy a bond whose payoff at time t+1 is Xt+1 = 5. Compute the demand of this bond when its price is pt = 1. b) Compute the same demand when = 0.5. Explain why it is different from a). c) Suppose that instead of a bond, the investor can buy a stock whose payoff Xt+1 is 0 with probability 0.5 and 10 with probability 0.5. Compute the demand of this stock when its price is pt = 1 (for B = 0.9). Explain the difference with ) what you found for question a. d) Finally, suppose that, like in question c, the agent can buy a stock. Its payoff 2t+1 is 5 with probability 0.5 and 15 with probability 0.5. Compute the demand of this stock when its price is pt 1 (for B = 0.9). Explain the difference with what you found for question c. = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts