Question: 10. Everything else equal, an excess demand for securities or supply of yield curve to be upward sloping. a. Short term, short term b. Long

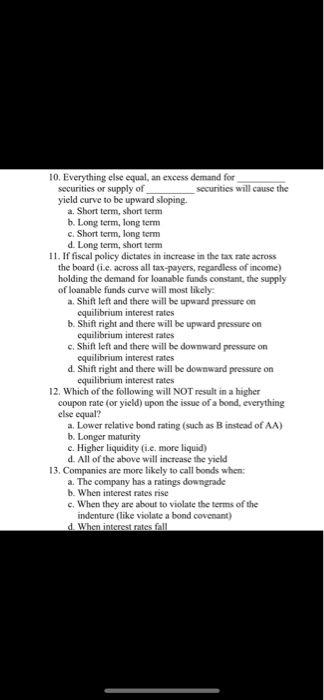

10. Everything else equal, an excess demand for securities or supply of yield curve to be upward sloping. a. Short term, short term b. Long term, long term c. Short term, long term d. Long term, short term 11. If fiscal policy dictates in increase in the tax rate across the board (ie. across all tax-payers, regardless of income) holding the demand for loanable funds constant, the supply of loanable funds curve will most likely: a. Shift left and there will be upward pressure on equilibrium interest rates b. Shift right and there will be upward pressure on equilibrium interest rates c. Shift left and there will be downward pressure on equilibrium interest rates d. Shift right and there will be downward pressure on equilibrium interest rates 12. Which of the following will NOT result in a higher coupon rate (or yield) upon the issue of a bond, everything else equal? a. Lower relative bond rating (such as B instead of AA) b. Longer maturity c. Higher liquidity (i.c. more liquid) d. All of the above will increase the yield 13. Companies are more likely to call bonds when: a. The company has a ratings downgrade securities will cause the b. When interest rates rise c. When they are about to violate the terms of the indenture (like violate a bond covenant) d. When interest rates fall

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts