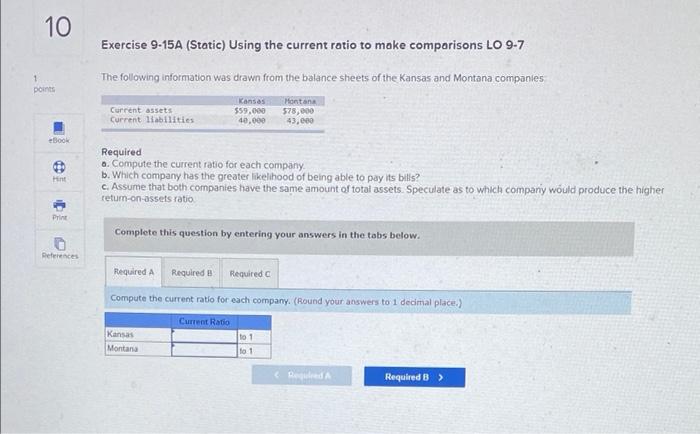

Question: 10 Exercise 9-15A (Static) Using the current ratio to make comparisons LO 9-7 1 points The following information was drawn from the balance sheets of

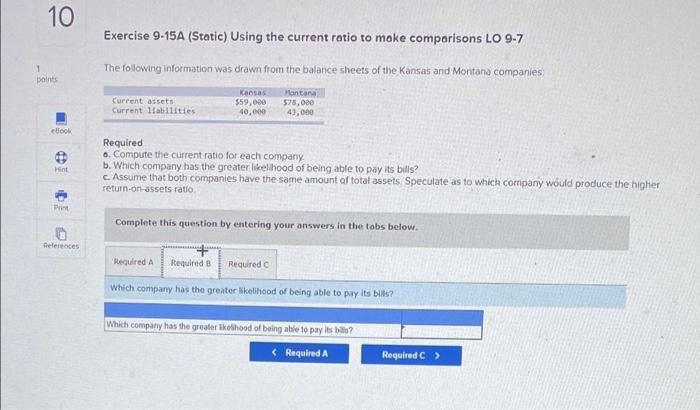

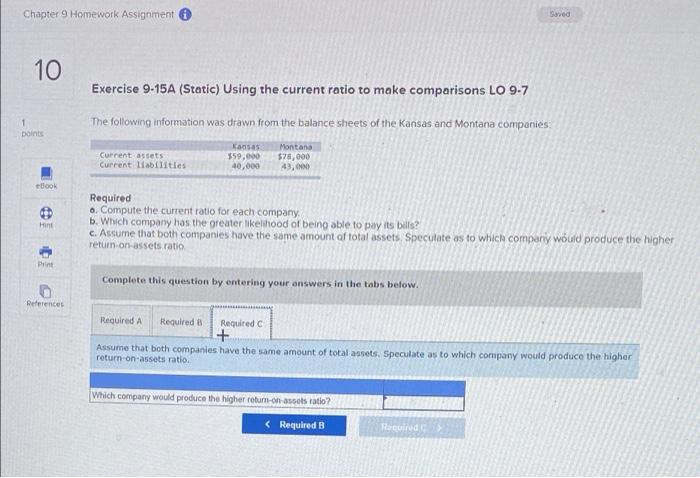

10 Exercise 9-15A (Static) Using the current ratio to make comparisons LO 9-7 1 points The following information was drawn from the balance sheets of the Kansas and Montana companies Kansas Montana Current assets 559.000 578,000 Current liabilities 40.000 43,000 -Book Hint Required a. Compute the current ratio for each company b. Which company has the greater likelihood of being able to pay its bills? c. Assume that both companies have the same amount of total assets. Speculate as to which companiy would produce the higher retum-on-assets ratio Print Complete this question by entering your answers in the tabs below. References Required A Required B Required Compute the current ratio for each company. (Round your answers to 1 decimal place.) Current Ratio Kansas Montana to 1 to 1 Red A Required B > 10 Exercise 9-15A (Static) Using the current ratio to make comparisons LO 9-7 1 paints The following information was drawn from the balance sheets of the Kansas and Montana companies Current assets Current Habilities Kansas $59,000 40.000 Montana 578,000 43,000 Doc Hint Required o. Compute the current ratio for each company b. Which company has the greater likelihood of being able to pay its bils? c. Assume that both companies have the same amount of total assets Speculate as to which companiy would produce the higher return-on-assets ratio Complete this question by entering your answers in the tabs below. References Required A Required Required which company has the greater kelihood of being able to pay its bills? Which company has the greater ikelihood of being able to pay is bili? Chapter 9 Homework Assignment Saved 10 Exercise 9-15A (Static) Using the current ratio to make comparisons LO 9-7 1 points The following information was drawn from the balance sheets of the Kansas and Montana companies Current assets Current liabilities Kaasas 359,000 40,000 Montana $78,000 43,000 Book Hint Required o Compute the current ratio for each company b. Which company has the greater likelihood of being able to pay its bills? c. Assume that both companies have the same amount of total assets Specutate as to which company would produce the Ngher return on-assets ratio Print Complete this question by entering your answers in the tabs below. References Required A Required Required + Assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return on-assets ratio Which company would produce the higher return-on-assets ratio?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts