Question: 10. For a premium bond, the: A. current yield is equal to the coupon rate but less than the yield to maturity. B. yield to

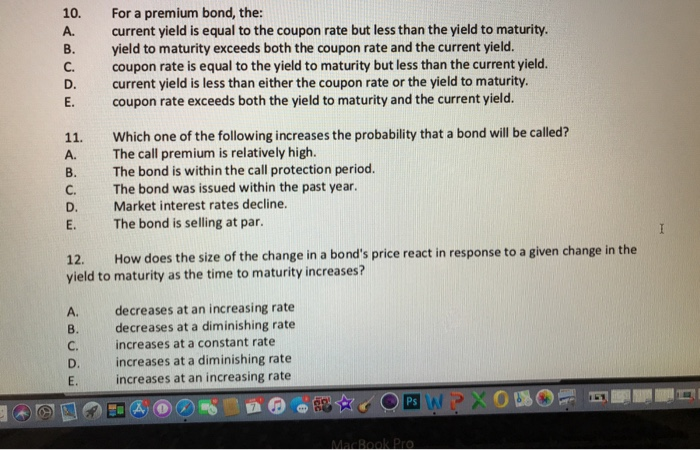

10. For a premium bond, the: A. current yield is equal to the coupon rate but less than the yield to maturity. B. yield to maturity exceeds both the coupon rate and the current yield C. coupon rate is equal to the yield to maturity but less than the current yield. D. current yield is less than either the coupon rate or the yield to maturity. E. coupon rate exceeds both the yield to maturity and the current yield. 11. Which one of the following increases the probability that a bond will be called? A. The call premium is relatively high. B. The bond is within the call protection period. C. The bond was issued within the past year. D. Market interest rates decline. E. The bond is selling at par. 12. How does the size of the change in a bond's price react in response to a given change in the yield to maturity as the time to maturity increases? A. decreases at an increasing rate B. C. increases at a constant rate D. increases at a diminishing rate E. decreases at a diminishing rate increases at an increasing rate Ps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts