Question: 10. In break-even analysis, the contribution margin is defined as A. Sales price minus variable cost B. Sales price minus fixed cost C. Varlable cost

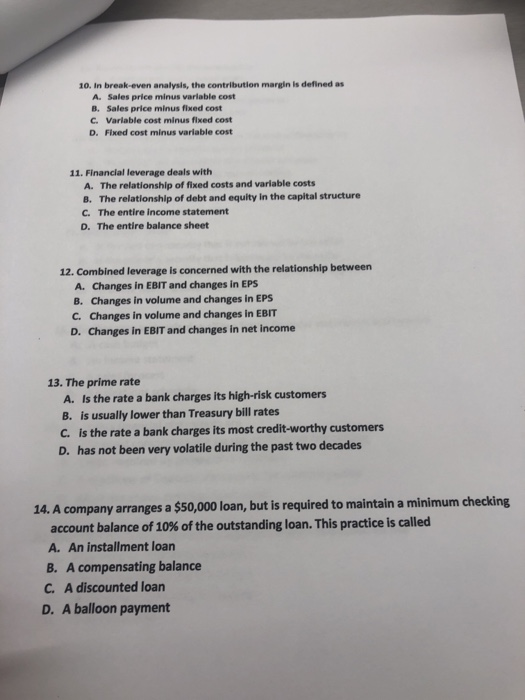

10. In break-even analysis, the contribution margin is defined as A. Sales price minus variable cost B. Sales price minus fixed cost C. Varlable cost minus fixed cost D. Fixed cost minus variable cost 11. Financial leverage deals with A. The relationship of fixed costs and variable costs B. The relationship of debt and equity in the capital structure C. The entire income statement D. The entire balance sheet 12. Combined leverage is concerned with the relationship between A. Changes in EBIT and changes in EPS B. Changes in volume and changes in EPS c. changes in volume and changes in EBIT D. Changes in EBIT and changes in net income 13. The prime rate A. Is the rate a bank charges its high-risk customers B. is usually lower than Treasury bill rates C. is the rate a bank charges its most credit-worthy customers D. has not been very volatile during the past two decades 14. A company arranges a $50,000 loan, but is required to maintain a minimum checking account balance of 10% of the outstanding loan. This practice is called A. An installment loan B. A compensating balance C. A discounted loan D. A balloon payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts