Question: 10. Income tax expense + Decrease in income tax payable - = Cash payments for income taxes 11. Free cash flow = Net cash

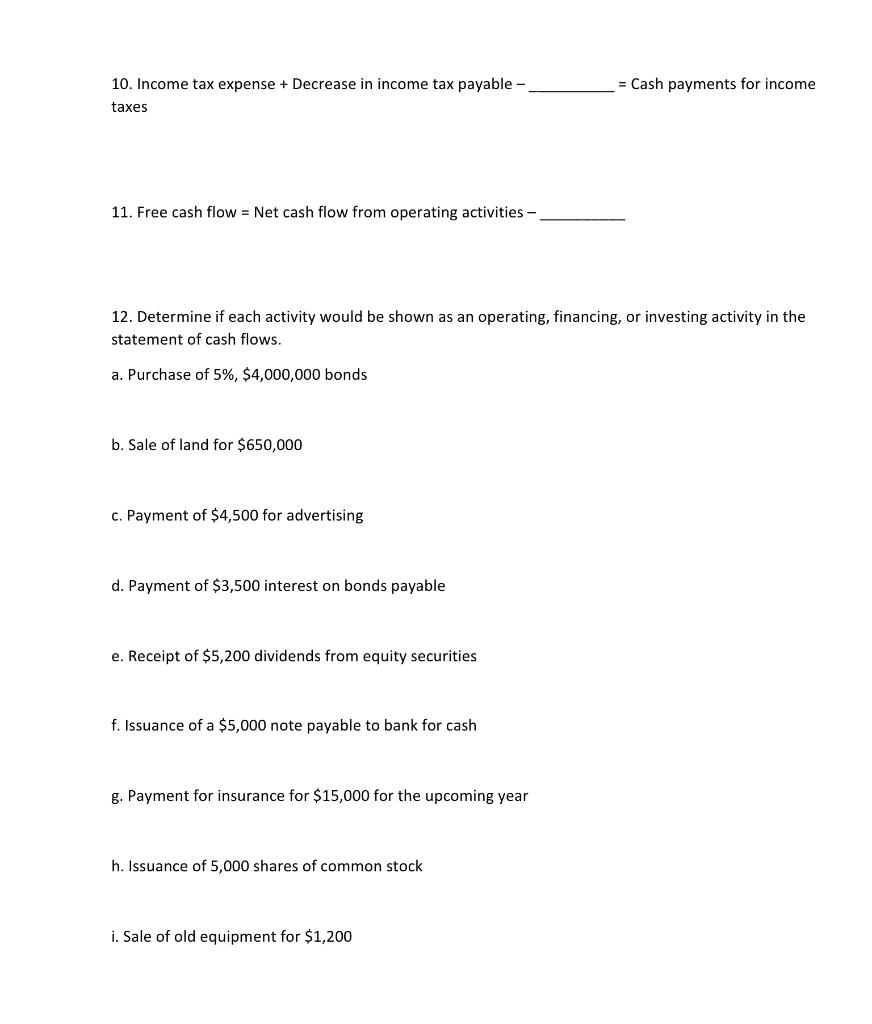

10. Income tax expense + Decrease in income tax payable - = Cash payments for income taxes 11. Free cash flow = Net cash flow from operating activities - 12. Determine if each activity would be shown as an operating, financing, or investing activity in the statement of cash flows. a. Purchase of 5%, $4,000,000 bonds b. Sale of land for $650,000 c. Payment of $4,500 for advertising d. Payment of $3,500 interest on bonds payable e. Receipt of $5,200 dividends from equity securities f. Issuance of a $5,000 note payable to bank for cash g. Payment for insurance for $15,000 for the upcoming year h. Issuance of 5,000 shares of common stock i. Sale of old equipment for $1,200

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

10 locome tax expense Decua se m Income tan payable p... View full answer

Get step-by-step solutions from verified subject matter experts